EMFI Suriname Country Report 2021

Related Cases:

-

8 Oct 2024

News Highlights

- The new crawling peg regime established a lower band of 14,290 SRD/USD and an upper band of 16,300 SRD/USD.

- The government also established anti-market measures such as mandatory repatriations and foreign exchange surrender requirements for exporters.

- We calculate that the net international reserves reach USD 129 mn, enough to cover only around 3 weeks of imports.

- The recently announced measures are a momentary solution that does not really tackle the underlying fiscal issues.

- SELL: The news about the government measures is not market-friendly, but Suriname’s debt remained unchanged in recent weeks due to the low volume of operations.

- Apache concluded drilling operations at Keskesi East-1 well due to high pressure.

- 3,021 Surinamese have been vaccinated.

Background

The “New” Foreign Exchange Policy

Negotiations between the Surinamese government and the International Monetary Fund are stalled pending exchange rate and budget reforms. On March 1, the government took a step forward and relaxed its exchange rate policy, shifting to a crawling peg from a de facto fixed exchange regime. The Central Bank established a lower band of 14,290 SRD/USD, which is the same rate that the old fixed system had, and an upper band of 16,300 SRD/USD.

In some exchange houses, the FX rate quickly reached the upper band of 16,300 SRD, a devaluation of 12.4%. This rate is still below the parallel market rate, which is between 18,200 and 18,500 SRD/USD according to local media. Although the crawling peg is a more flexible model than the previous one, it is not a market-determined exchange rate regime like the one recommended by the IMF. The government seems not to be willing to go that far, but will the crawling peg be enough for the IMF?

Along with the FX regime reform, the government introduced other complementary measures to stabilize the exchange rate as of March 1:

- All resident exporters must repatriate all their export proceeds (from 60% in the previous law).

- Exporters must convert 30% of their proceeds to local currency.

- Importers will have to pay for their imports through Surinamese foreign exchange banks.

All these measures will be part of an amendment to the controversial Foreign Exchange Law amended a year ago by the Bouterse government.

Fixed exchange regimes have a long history in Suriname. Since its independence in 1975, the government has sometimes abandoned them temporarily but always ends up returning to this type of scheme. Suriname had an official crawling band scheme between 1975 and 1982, and between 1999 and 2000. It also maintained a de facto crawling band between 1994 and 1998. The “new” exchange regime would be the fourth attempt at a band policy.

The Suriname Association of Economists urged the government to let the exchange rate float and be determined by the market. The IMF has repeatedly recommended that Suriname should adopt a flexible exchange rate given its position as a commodity exporter, which makes it vulnerable to external shocks. However, President Santokhi thinks that allowing the exchange rate to float freely is irresponsible because if it does so, “who knows where the exchange rate will end?” At the press conference in which the government announced the new exchange rate regime, the Minister of Finance and Planning, Armand Achaibersing, said, “the government is there for our people and not for the IMF.” These kinds of statements resemble those made by the Bouterse administration when it abandoned the agreement with the IMF, arguing that it was “too much” for the citizens of Suriname.

The policies that regulate export revenues are not new either. Until May 2002, all exporters had to repatriate all their export proceeds and partially surrender foreign currency to the Central Bank. In this sense, the measures proposed by the government of President Santokhi not only recall the past but also bring to mind non-market-friendly countries like Sri Lanka and Argentina. Sri Lanka recently implemented such measures in an attempt to move away from the IMF and towards China instead, as the Sri Lankan government clearly expressed its preference for “non-interventionist” lenders. It seems contradictory for the Surinamese government to take similar heavy-handed measures amid friendly negotiations with the IMF.

Agricultural exporters rejected the foreign exchange surrender requirements and demanded that it be reversed immediately. The Federation of Agricultural Exporters said that “it cannot imagine how the same government that promotes the importance of the manufacturing sector (…) makes decisions that are a dagger for agricultural production and exports.” Indeed, these measures will, in the medium term, discourage exports, and could even worsen external imbalances.

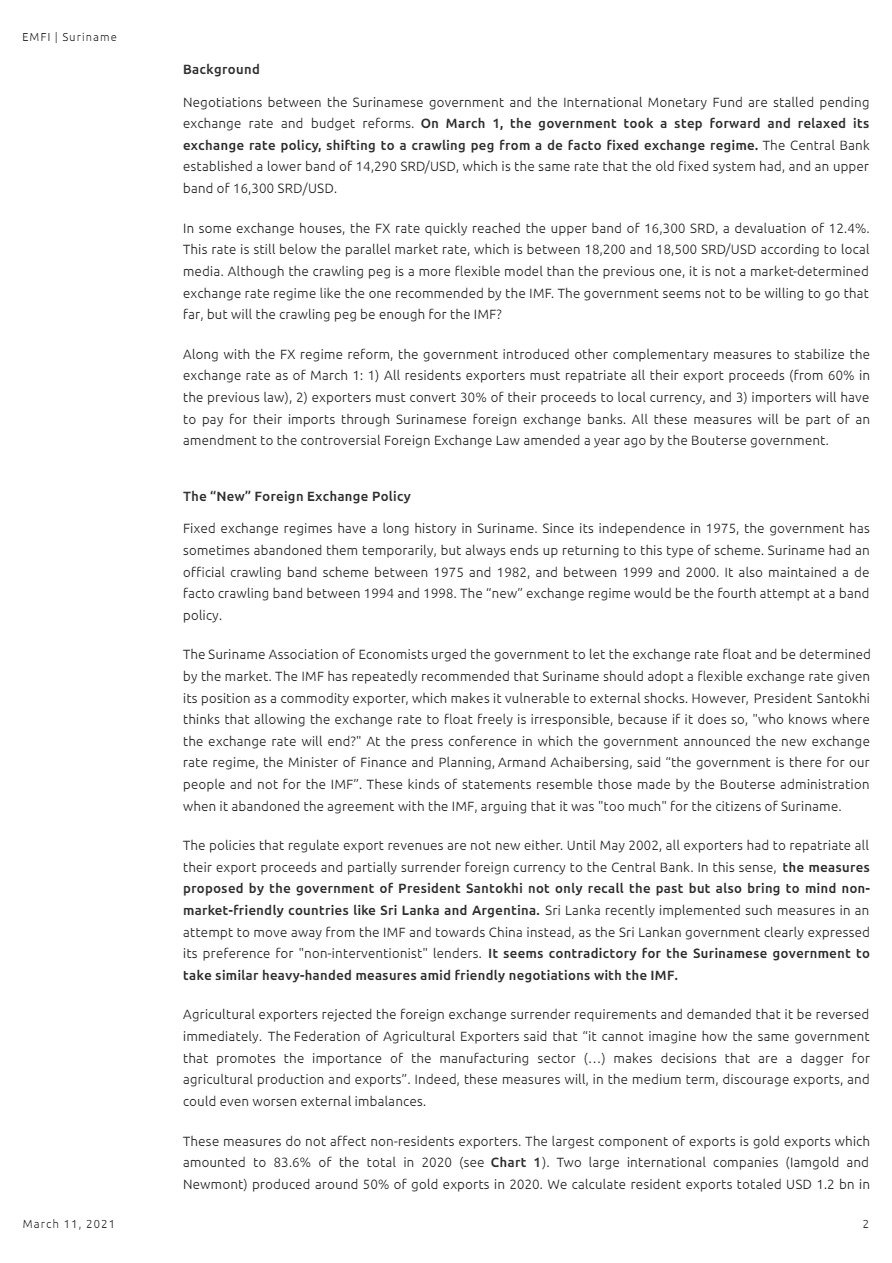

These measures do not affect non-resident exporters. The largest component of exports is gold exports, which amounted to 83.6% of the total in 2020 (see Chart 1). Two large international companies (Iamgold and Newmont) produced around 50% of gold exports in 2020. We calculate resident exports totaled USD 1.2 bn in 2020. Taking this number, we calculate that the surrender requirements during 2021 would amount to USD 543.4 mn. This would be enough for the Central Bank to absorb 15.6% of the broad money (considering that it keeps the broad money of January constant). However, a more credible assumption would be that broad money will grow at the same rate as in 2020 (62.1%). In this scenario, the Central Bank would absorb 9.7% of broad money. Although the impact would be substantial in stabilizing the exchange rate, it would also create disincentives to trade, raising transactional costs and hurting domestic exporters.

Desperate Times Call for Desperate Measures

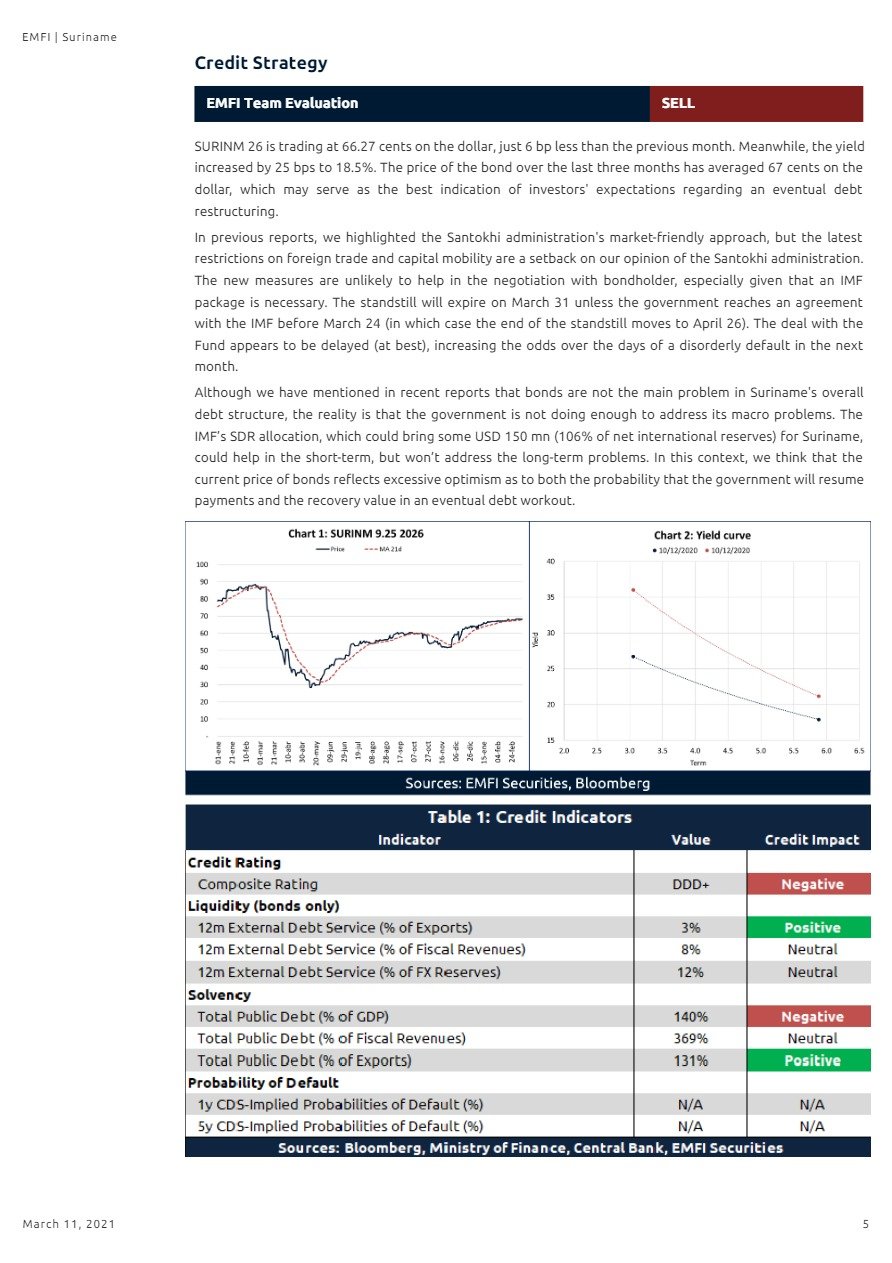

The measures approved by the government of Suriname aim to strengthen the country’s external buffers, namely the FX reserves. Gross international reserves stood at USD 601 mn in January, and while that represents an increase of 2.9% compared to December, it also means that reserves would barely cover 3.3 months of imports (See Chart 2). Although there was an improvement compared to 1Q20, it is not enough. According to the latest Article IV of the IMF, an adequate level of reserves must be greater than 4 months of imports. Suriname’s situation is even more critical because gross international reserves include the required reserves of commercial banks that the government cannot use to pay for imports. The reserve requirement figures included in international reserves are not public. If the figure reported by the finance ministry in the presentation to investors in September remained in proportional terms, we estimate that net international reserves amount to USD 129 mn, enough to cover around 3 weeks of imports.

Considering the level of net international reserves, we understand why the government implemented these measures that seem opposite to the IMF’s suggestions. With that said, they still feel like desperate measures that serve as a momentary solution while waiting for IMF funds. However, it is striking that the government has not communicated it in this way: the government has not explained whether these measures are provisional, nor did it highlight the solution to the underlying fiscal issues, which are the main cause of exchange rate imbalances. On the contrary, the government announced a new fuel subsidy and froze certain basic goods prices. Also, the government has not yet fulfilled the promise it made in mid-January to publish another budget bill. We believe that the communication of these measures is a setback for President Santokhi, as the measures appear isolated and undermine the credibility of a potential stabilization plan.

What to expect?

The Santokhi government appears to have taken an unexpected turn towards heterodox economic policies. Suriname has followed in the footsteps of countries such as Sri Lanka or Argentina by imposing anti-market measures such as mandatory repatriations and foreign exchange surrender requirements for exporters. Although government representatives defended the new measures despite not being in line with IMF advice, they still maintain that the talks with the IMF are on the right track. Thus, while we believe that the new measures reduced the odds of an agreement with the IMF, we maintain our baseline scenario that Suriname will reach an agreement with the multilateral institution.

On the other hand, the outlook for oil activities is positive. In the announcement of its quarterly results, Apache Corp revealed that most of its upstream Capex in 2021 will go to Suriname. The company will invest USD 200 mn in the construction of two rigs as part of its exploration program. Apache expects to be pumping crude oil in 2025.

However, the heterodox “solutions” in the present could cloud the bright future. After almost eight months in the presidency, Santokhi has only implemented the so-needed currency devaluation and no other major policy measure to stabilize the economy. The recently announced policies are a short-term fix that does not really tackle the underlying fiscal issues, throwing a wrench into the relationship with the IMF while kicking the can down the road for the most important challenges facing the country.

Important Disclosures

Bron:

Link:

Interne Link:

Tags: