Central Bank Strategy Rethought Enhancing Stability and Growth

Related Cases:

-

8 Oct 2024

Central Bank Strategy Rethought: Enhancing Stability and Growth

Robert van Trikt, Governor

14 November 2019

Agenda

- Main Functions of CBVS

- Modernization of Monetary Policy Framework

- Exchange Rate Policy

- Recent Economic Developments

- Challenges Facing CBVS

- Policy Responses

- Road Ahead

1. Main Functions of the Centrale Bank van Suriname (CBVS)

According to Article 9 of the Bank Act (1956), the main functions of the CBVS are:

- Promoting monetary stability

- Issuing and circulating the national currency, facilitating cashless payments

- Promoting financial stability

- Supervising the financial sector

- Promoting and facilitating international transactions

- Promoting sustainable socioeconomic development

Additionally, the CBVS acts as a banker for the Government and commercial banks.

2. Modernization of the Monetary Policy Framework

Since March 2019, the Central Bank has pursued an active monetary policy, managing liquidity to ensure monetary stability. Recent developments include:

- Introduction of new monetary policy instruments

- Creation of the Monetary Policy Advisory Committee (MPAC) and Senior Credit Committee

- Implementation of Certificates of Deposit and Gold Certificates (July 2019)

- Launch of standing facilities and Emergency Liquidity Assistance (September 2019)

3. Exchange Rate Policy

The FX market in Suriname exhibits the following challenges:

- Oversupply of € cash and excess demand for US$ cash

- High dollarization of the economy, with key sectors transacting in foreign currency

- A thin and dysfunctional FX market

Policy measures to address these issues include:

- Active liquidity management through new monetary instruments

- FX support for essential imports and mitigating cash shortages

- Legal action to recover seized funds and efforts to repatriate export earnings

4. Recent Economic Developments

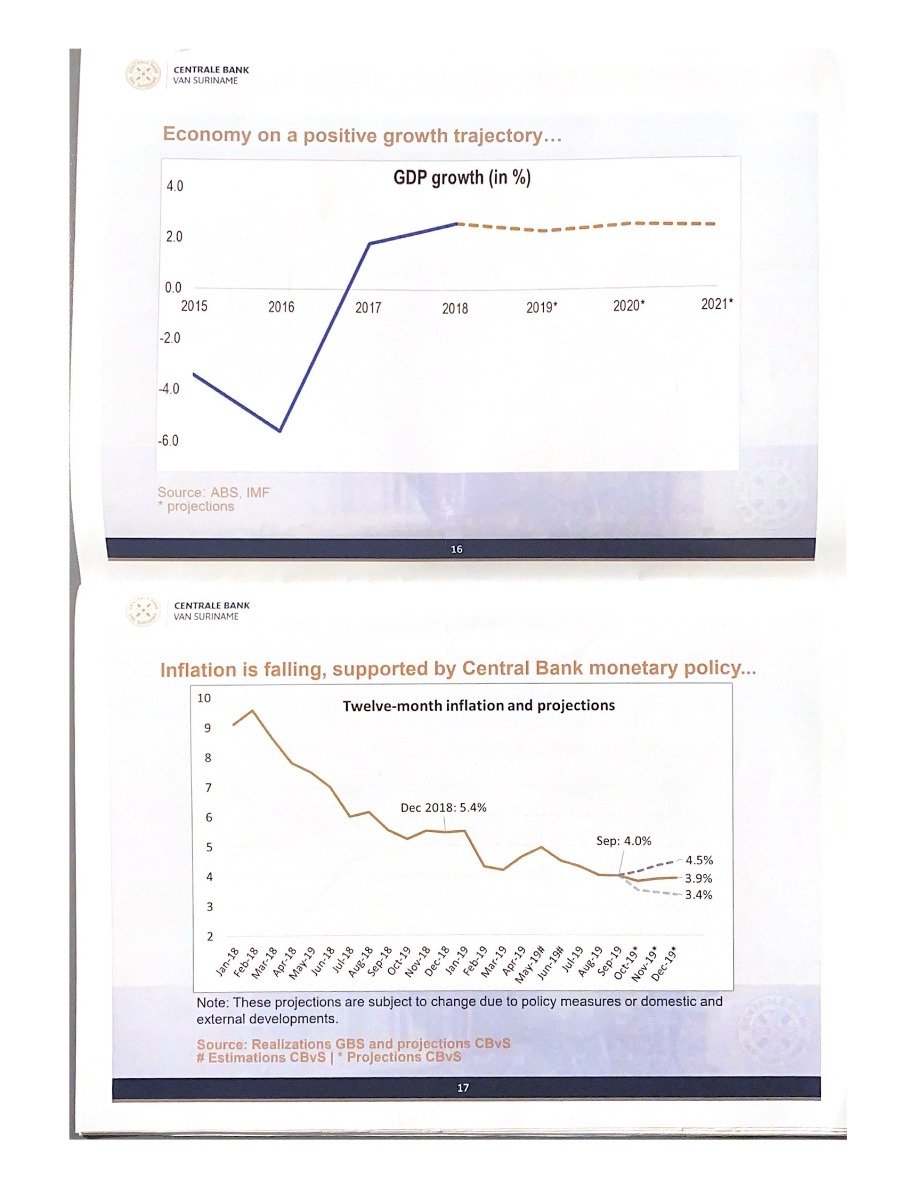

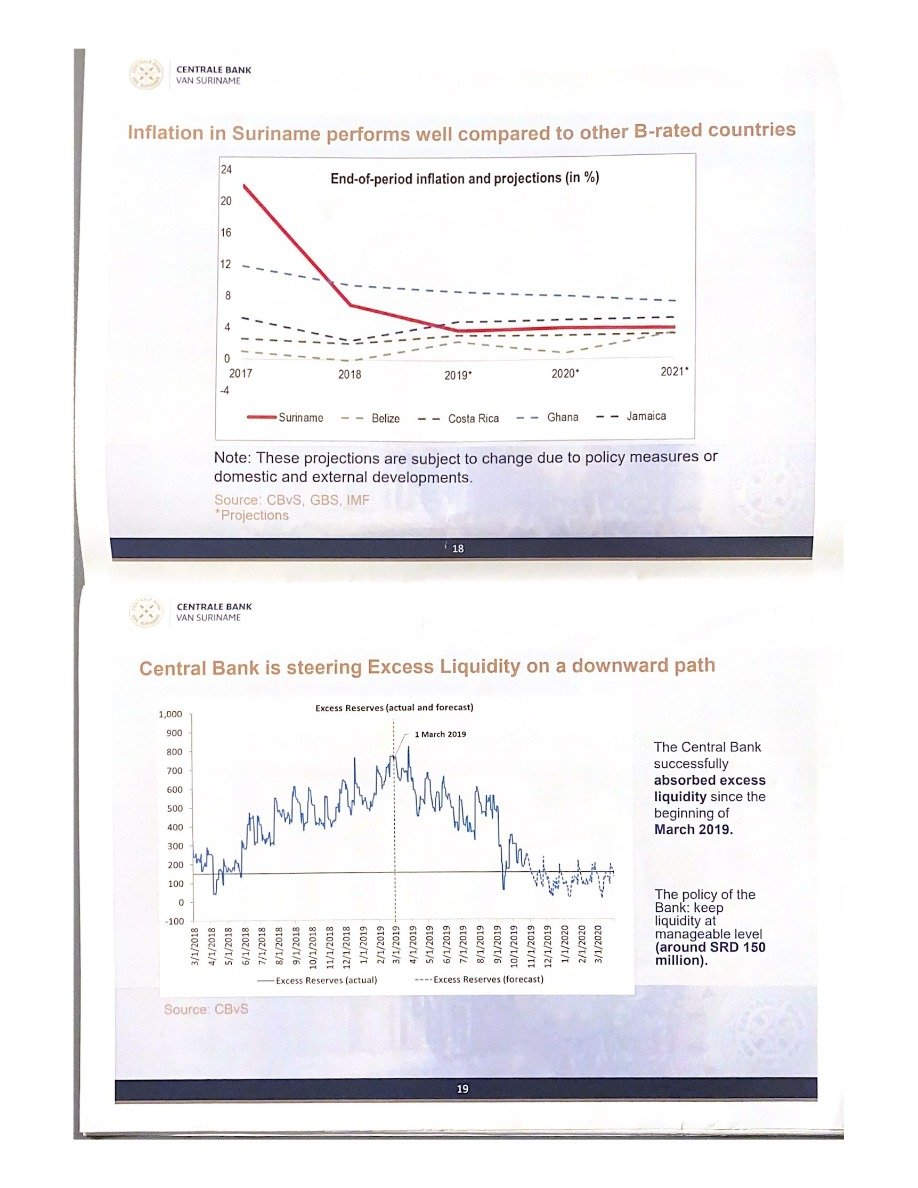

The economy is showing positive growth, with GDP projected to grow steadily. Inflation is under control, supported by Central Bank policies. International reserves are expected to exceed USD 800 million by the end of 2019, improving import coverage and financial stability.

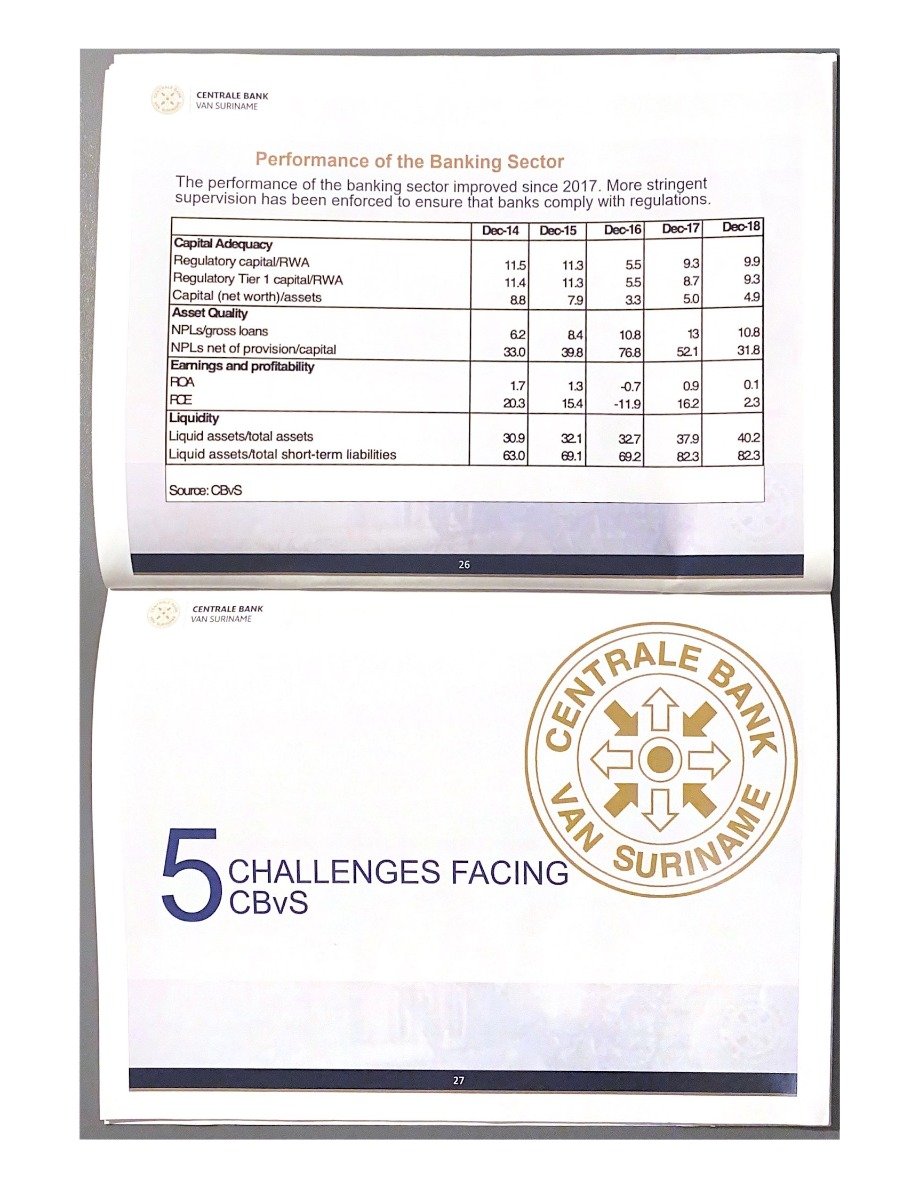

5. Challenges Facing CBVS

CBVS operates in a dynamic environment, facing:

- The unjustified seizure of a money shipment in 2018, which impacted the FX market

- The need for innovation and financial inclusion

- Legal framework reform for the financial sector

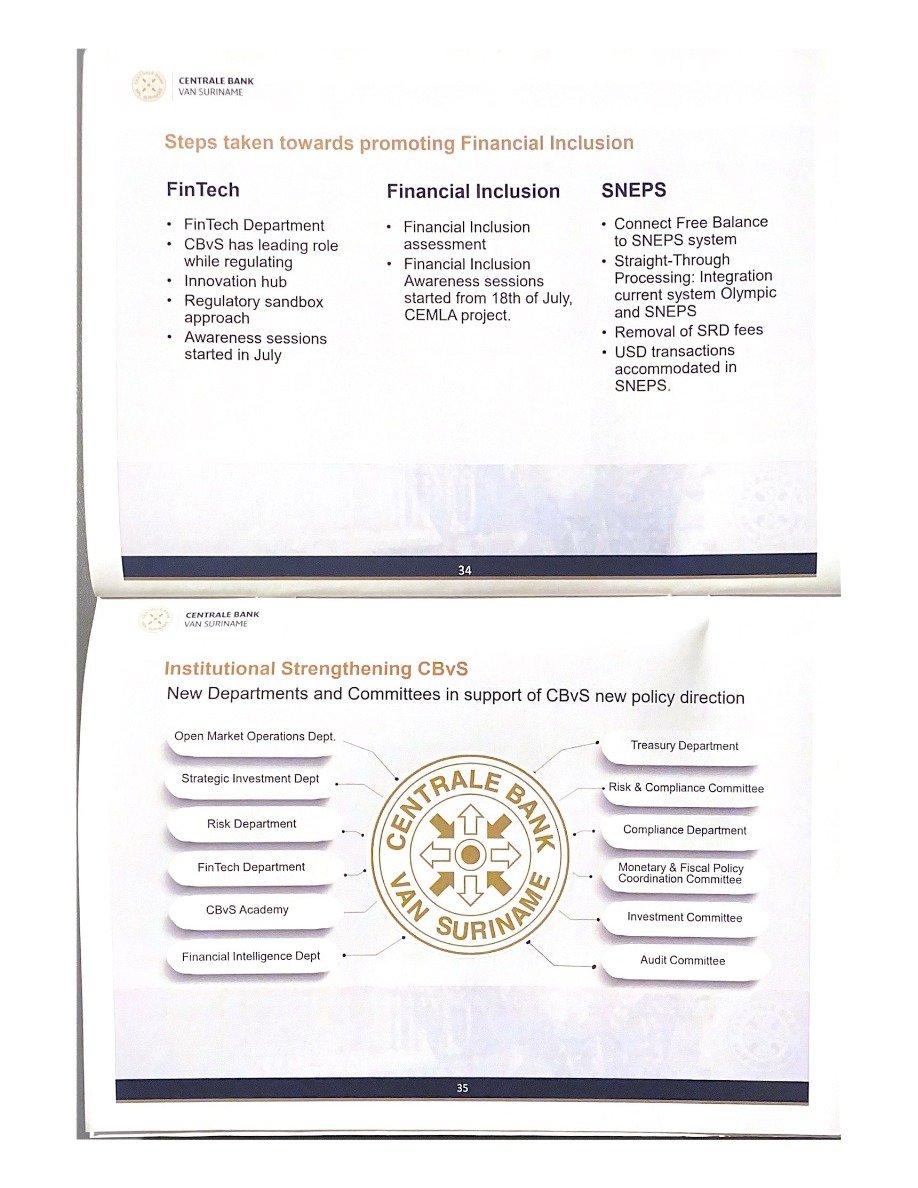

- Institutional strengthening of the CBVS

6. Policy Responses

Key policy responses include:

- Strengthening the international reserve position

- Promoting financial stability through improved supervision and regulations

- Encouraging financial inclusion through FinTech and modernized payment systems

- Implementing measures to mitigate the effects of speculative behavior on the exchange rate

7. Road Ahead

Looking ahead, the CBVS will continue to focus on:

- Maintaining low inflation and stable exchange rates

- Accumulating international reserves

- Enhancing financial sector supervision and governance

- Completing the National Risk Assessment by 2020

Bron:

Link:

Interne Link:

Tags: