200107 CBvS Strategisch Plan A5 Final

Related Cases:

-

8 Oct 2024

CENTRALE BANK VAN SURINAME STRATEGIC PLAN 2019 – 2021

The Nation’s Anchor for Sustainable Stability

Message from the Governor

Institutional Profile

2.1 Introduction

2.2 Strategic Plan 2019-2021

2.3 Mandate, Mission Statement, Vision, and Core Values

2.4 Governance and Organizational Chart

A Dynamic Environment

3.1 Economic Developments

3.2 Regulatory Trends

3.3 Technology Trends

Strategic Framework 2019-2021

4.1 Strategic Pillars, Goals & Projects

4.2 Implementation Approach

Appendices

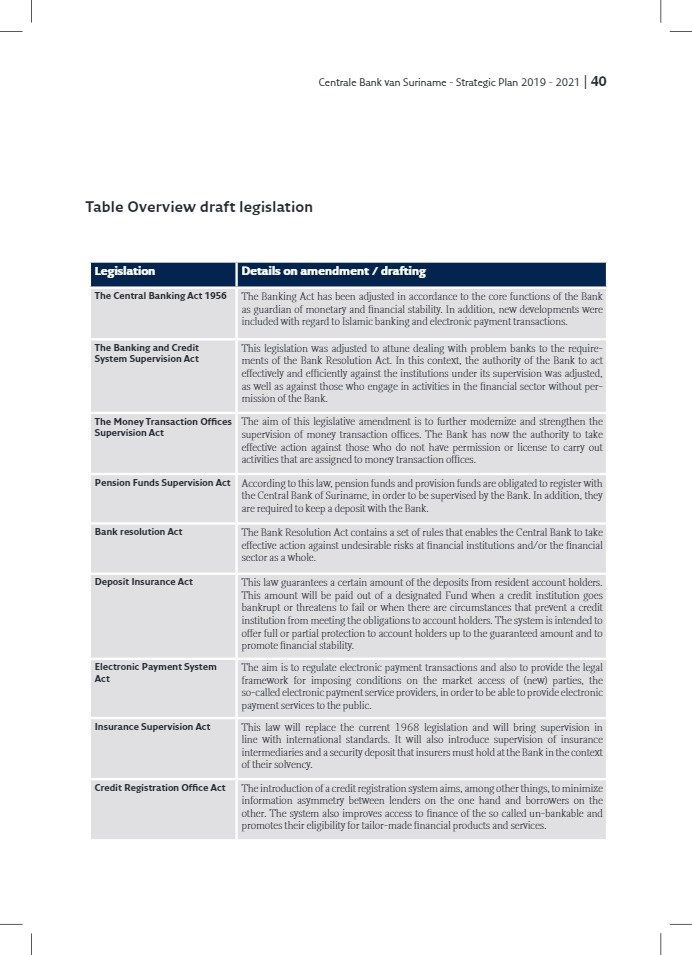

- Overview Draft Legislation

- Project Monitoring Cycle

OVERVIEW

What if every Surinamese citizen could benefit from the wealth of our natural resources? What if we can omit our worries about exchange rate and fiscal challenges and start building towards prosperity for every citizen? As Governor of the Central Bank of Suriname (the Bank), I see this as one of the most important tasks for this policy period.

In addition to our core tasks of ensuring monetary and financial stability, there will be a strong focus on our contribution to the socio-economic development of Suriname, as stated in Article 9 of the Bank Act. In this regard, the Bank will fulfill an incubator’s role to spearhead initiatives to establish a more diverse strategy to accelerate more wealth for future generations.

MESSAGE FROM THE GOVERNOR

Going forward, the Bank will ensure that the economy of Suriname remains on a sustainable growth path while maintaining monetary and financial stability. We are therefore constantly seeking possibilities to utilize our natural resources in the best interest of the country and our citizens.

Furthermore, we are committed to implementing an effective policy mix – monetary, fiscal, and structural – in collaboration with key stakeholders to achieve strong, sustainable, balanced, and inclusive growth for Suriname. We will also implement effective policies and tools contributing to economic growth, social development, financial stability, and financial inclusion.

In order to achieve this, we must have a strong and flexible organization that can swiftly address challenges and opportunities arising from the dynamic environment in which we operate. Therefore, we have set out a path for strengthening corporate governance, developing leadership, and further enhancing essential functions within the organization. Furthermore, we are on the right track to leveraging technology to modernize our payment systems and reduce the use of cash.

FinTech initiatives have great potential to promote financial inclusion by increasing the accessibility and efficiency of financial services while reducing transactional costs. The Bank reiterates the importance of FinTech in the design and implementation strategies for financial inclusion. We acknowledge our role in the adoption of FinTech and are shaping our internal processes and legal framework to regulate local FinTech start-ups.

We note that digitalization and FinTech provide opportunities to shape the future of the finance industry by increasing the ease, speed, and traceability of transactions. Last but not least, we will enhance collaboration in achieving our strategic goals by working closely with key stakeholders at the national level and by stimulating international partnerships with other central banks to strengthen our institutional capacities.

The Strategic Plan 2019-2021 will act as a roadmap to guide us in achieving the ambitions of the Bank. In the process, we will continuously learn and adapt to emerging developments and challenges while ensuring that the objectives of the Strategic Plan are always taken into consideration.

I recognize that ambitions are set high and the pace at which we should achieve our objectives is fast. We, as the Central Bank of Suriname, will make every effort to achieve our overarching goal: providing the appropriate conditions for sustainable economic growth.

Robert van Trikt

Paramaribo, August 2019

Suriname is the 17th richest country in the world in natural resources. The Central Bank must ask itself what its role should be in ensuring that the country fulfills its potential and is up to speed with international markets.

Robert van Trikt

2.1 Introduction

Governor Robert van Trikt took office on March 5th, 2019. After assessing the situation of the Bank and considering the challenges in the economy, the Governor determined the strategic course for the medium term. Since the rollout of the Strategic Plan 2018-2021, various developments have necessitated an evaluation of the strategic priorities for the Bank up to 2021.

A review of the strategic pillars and objectives was conducted, concluding that the Bank should implement urgent reforms, both on the business side and in the area of monetary policy. As a precondition for implementing some of these reforms, legislation and regulations needed to be amended, and new initiatives needed to be taken to enhance the income-generating capability of the Bank.

Furthermore, swift actions were required to strengthen the international reserves, actively manage excess liquidity in the financial system, and execute the upcoming National Risk Assessment (NRA) in preparation for the Fourth Round Mutual Evaluation by the Caribbean Financial Action Task Force (CFATF) planned for July 2020. A successful completion of the NRA and Mutual Evaluation is deemed of national importance.

Additionally, it was determined that the internal organization requires enhanced focus, particularly the governance within the Bank. Based on these challenges and developments, policy priorities and initiatives have been identified to bridge the gap toward the desired state of the Bank in 2021.

2.2 Strategic Plan 2019-2021

After reviewing the Strategic Plan 2018-2021 and setting the new strategic priorities, the strategic course for the medium term was developed. To this end, strategic sessions were held in June 2019 with the management and other stakeholders in the Bank, and the Strategic Plan 2019-2021 was formally launched by the Governor in August 2019. To ensure effective implementation, strategic projects will be monitored on a half-yearly cycle, with progress reports every two months.

Two additional strategic pillars: governance and sustainable economic development.

Special attention will be given to strengthening and enforcing the governance structure within the Bank. The Three Lines of Defense principle, with a well-established risk management, compliance, and internal audit function based on best practices, are key to this internal reform.

Furthermore, to support the role the central bank plays in promoting balanced sustainable economic development of Suriname, as set forth in the Bank Act, a separate pillar was added to the plan.

2.3 Mandate, Mission Statement, Vision, Slogan, and Core Values

Mandate

The Central Bank of Suriname (the Bank) started its activities on April 1, [year needed].

The mandate of the Bank, as amended in the Bank Act (G.B. 1956 no. 97, current statement S.B. 2010 no. 173), consists of the following tasks:

a. To promote the stability of the national currency;

b. To provide for the money circulation in Suriname, concerning banknotes, as well as facilitating cashless payments;

c. To promote the development of a sound banking and credit system in Suriname;

d. To supervise the banking and credit system, the pension and insurance system, foreign exchange transactions, and the transfer of financial resources to and from abroad, all subject to the applicable statutory regulations; the supervision also aims to preserve the integrity of the institutes operating in these sectors and subsectors;

e. To promote and facilitate the flow of payments between Suriname and foreign countries;

f. To promote the balanced socioeconomic development of Suriname.

Mission Statement

Our mission is derived from the Bank’s mandate as set out in Article 9 of the Banking Act.

The mission statement is as follows:

Promoting monetary and financial stability in pursuit of socio-economic development.

Vision

The Bank is setting its direction by defining its vision. With this vision, the Bank wants to inform all stakeholders about its ambitions and the future state of the Bank and our financial system.

The vision is as follows:

The Central Bank of Suriname, an autonomous monetary and financial authority that co-directs the sustainable economic development of our country in a professional and transparent manner.

Slogan

To know the vision by heart, a slogan was derived from the vision.

The slogan is as follows:

The Nation’s Anchor for Sustainable Stability.

2.4 Core Values

To realize our vision, the following core values are deemed critical to getting the work done in a professional manner:

- Respect

We deal with internal and external stakeholders respectfully, based on equality and appreciation of everyone’s qualities. We earn respect through our actions and the way in which we contribute to serving society. - Integrity

All employees of the Bank abstain from misuse of knowledge and facilities to which they have access due to their involvement with the Bank. Acting with integrity, honesty, and sincerity characterizes the Bank and its employees. - Dedication

We at the Bank honor our commitments, and we go the extra mile. We are aware that we are part of a larger whole and act in the interest of society. It is our Bank, it is our country, and we go for it. - Expertise

The Bank is a professional organization; the Bank’s services are consistently of high quality. We therefore maintain a critical attitude towards ourselves and continuously expand our knowledge and expertise. The Bank invests in its employees to enable them to continue to deliver added value. - Teamwork

Collaboration and team spirit are determining factors in achieving success in our work at the Bank. The Bank strives for a good working environment where there is openness, diligence, and accountability. Every employee contributes to a pleasant cooperation and working environment in our institute.

2.4 Governance and Organizational Chart

The Governor is appointed by the Government for a term of five years and is responsible for the management of the Bank. Executive directors may be appointed to assist the Governor, who reports to the Supervisory Board consisting of non-executives. The Bank comprises four directorates, each headed by a Director, and includes several departments related to the functions of a central bank.

With the appointment of the new Governor, the organization and governance structure were reviewed, and it was concluded that changes in the organizational structure were necessary. A new directorate was added, transforming the General Secretariat Department into the Directorate Legal Compliance and International Affairs. The other three Directorates remain the same: Directorate Banking Affairs, Directorate Monetary and Economic Affairs, and Directorate Supervision.

Based on good governance, a new corporate governance code has been approved by the Supervisory Board. With the new corporate governance code as a starting point, some existing departments were strengthened in capacity while some new departments and committees were set up, among others: the Compliance Department, Risk Management Department, Audit Committee, and Risk & Compliance Committee.

Other departments were also added to the organizational structure, such as the Strategic Investment Department, the Financial Intelligence Department, the FinTech Department, and the Open Market Operations Department.

Here’s a formatted version of your text that enhances readability and organizes the information clearly:

- Audit Committee

- Risk and Compliance Committee

- Governor

- SEK – Secretariat

- BEV – Security Department

- SID – Strategic Intelligence Department

- HRM – Human Resource Management

- IAU – Internal Audit

- SPM – Strategic & Project Management Department

- CBA – CBvS Academy

Directorate Legal, Compliance, and Internal Affairs

- COM – Compliance

- PRO – Protocol & Traffic

- VPR – Information & Public Relations

- JUR – Legal Affairs

- IRE – International Relations

- BIB – Library

- NUM – Numismatic Museum

Directorate Banking Affairs

- RSK – RISK

- STO – Staff Department

- ICT – Information & Communication Technology

- PRM – Procurement

- TRE – Treasury

- BIN – Domestic Department

- KAS – Cashier Department

- BTL – Foreign Department

- FIT – FinTech

- FIC – Financial Control

- ACC – Accounting

- BNC – Budget & Control

- RAP – Reporting

- ARC – Archive

- LAB – Gold Laboratory

- ALZ – Facilities

- AEA – Agenda

- HHD – Housekeeping

- TCD – Technical Department

- MAG – Stockroom

Directorate Supervision

- STO – Staff Department

- GTK – Money Transaction Offices

- TBN – Bank Supervision

- TSP – Credit Union Supervision

- TPF – Pension Funds Supervision

- TVZ – Insurance Supervision

- INT – Integrity Supervision

Directorate Monetary & Economic Affairs

- STO – Staff Department

- STA – Statistics

- RES – Research

- FST – Financial Stability

- FCM – Financial Markets

- OMO – Open Market Operations

- FID – Financial Intelligence Department

Strategic Framework

As the Central Bank of Suriname, we operate in a dynamic national, regional, and global environment. We continuously assess our environment to determine relevant challenges and opportunities, which we need to address. This assessment forms the basis for determining our strategic priorities. Below are the highlights of the environmental context from different perspectives.

3.1 Economic Trends

Global and Regional Outlook

The growth of the world economy will remain moderate in 2019, as geopolitical tensions in different regions adversely affect the global outlook, according to the International Monetary Fund (IMF). The IMF has adjusted the growth outlook for the world economy downwards to 3.2% in 2019, with expectations of a slight increase to 3.4% in 2020.

Suriname Outlook

Suriname’s economy is on a growth trajectory, having recovered from the recession of 2015-2016, expanding by 2.6% in 2018, primarily driven by the wholesale & retail sector and agriculture, livestock & forestry. The growth prospects for Suriname are favorable, mainly due to high international gold prices and operationalization of the Saramacca mine.

3.2 Regulatory Trends

National Risk Assessment

Suriname is conducting the National Risk Assessment (NRA) in preparation for the CFATF Fourth Round Mutual Evaluation of 2020. This assessment is critical to ensure compliance with Anti-Money Laundering laws.

Modernizing Financial Legislation

The Bank has worked on modernizing and strengthening financial legislation to keep pace with international developments and prepare for the Fourth Round Mutual Evaluation.

Implementing International Financial Reporting Standards

With the entry into force of the Financial Statements Act, businesses in Suriname must adhere to the International Financial Reporting Standards (IFRS).

3.3 Technology Trends

Opportunities and Challenges of Financial Technology

Traditional business models are challenged by rapid technological developments in the financial sector. The challenge lies in balancing the risks with opportunities for enhanced financial services.

FinTech Developments

Suriname is predominantly a cash-based economy. The Bank recently launched an Innovation Hub to engage with banks and FinTech firms to promote digital payment solutions.

4.1 Strategic Pillars, Goals, and Projects

Based on the vision for 2021, the strategic path was developed, translating into 7 strategic pillars, 18 goals, and a total of 51 projects:

- Monetary Stability

- Financial Stability

- Payment System

- Internal Operations

- Governance

- Communication

- Sustainable Economic Development

Pillar 1: Monetary Stability

Promoting stability in the value of the monetary unit, the SRD, is one of the Bank’s primary tasks. The Bank will continue to work to fulfill this crucial role by implementing various strategic projects.

Pillar 2: Financial Stability

A stable financial system is essential for achieving sustainable economic growth. Solid financial institutions are an essential element in this. As a financial authority, the Bank plays a role in both limiting risks and financial events that may have structural negative consequences for the entire financial system and in taking measures when negative events manifest themselves in the financial system. Within this context, the Bank also has a major role to play in setting up the architecture of the financial sector.

Strategic Goals and Projects

To achieve strategic pillar 2, the following strategic projects are being implemented:

- Implementing a reserve money targeting regime

- Projects:

- 3.1 Developing a macro-prudential policy framework and macro-prudential indicators.

- 3.2 The measurement and identification of financial interconnectedness and the resulting risks, as well as the development and implementation of the Higher Loss Absorbency (HLA) requirement for Domestic Systemically Important Banks.

- Projects:

- Implementing a reinforced set of instruments for effective supervision

- Projects:

- 4.1 Developing and implementing Islamic Banking supervision.

- 4.2 Incorporation of the Financial Action Task Force (FATF) recommendations into the supervisory framework.

- 4.3 Issuance of guidelines based on the Financial Statement Act, including the International Financial Reporting Standards (IFRS), and the adaptation and introduction of manuals for completing reporting statements.

- 4.4 Strengthening the supervision of financial institutions.

- 4.5 Formulating and implementing laws and guidelines required to carry out supervision in accordance with international standards.

- Projects:

- Strengthening laws and regulations in the financial sector

- Projects:

- 5.1 Identifying and formulating missing/incomplete legislation.

- 5.2 Preparation of guidelines.

- 5.3 Issuing sanctions and penalty policy.

- Projects:

- Making formal financial services accessible to everyone

- Projects:

- 6.1 Performing a “Financial Inclusion” baseline measurement with the Alliance for Financial Inclusion (AFI) and all relevant stakeholders.

- 6.2 Adopting and implementing a “Financial Inclusion and Education” policy strategy.

- Projects:

Pillar 3: Payment System

Facilitating and promoting modern, transparent, and secure payments for society promotes financial integration, supports financial stability, and thereby contributes to economic development. Well-developed payment systems are supported by a solid legal and regulatory framework. Work will focus on establishing and maintaining a financial architecture that meets the aspirations of the financial sector and users of financial services.

As we acknowledge that FinTech innovations will change the financial payments landscape, one of our key focus areas in the coming years will be to stimulate and regulate modern financial services supported by FinTech. The Bank will leverage technological innovation in the financial sector to promote financial inclusion and electronic payments instead of cash payments.

Strategic Goals and Projects

To achieve strategic pillar 3, the following strategic projects are being implemented:

- Further reshaping of the payment system to increase efficiency and reduce cash

- Projects:

- 7.1 Develop and implement a national policy for reducing cash payments.

- 7.2 Ensuring full use of the functionalities of the Suriname National Electronic Payment System (SNEPS).

- Projects:

- Stimulate the modernization of electronic payment traffic

- Projects:

- 8.1 Setting up FinTech to stimulate and regulate new and digital financial services.

- 8.2 Establishing operational procedures for applying for permits and supervising electronic payment transactions.

- Projects:

Pillar 4: Internal Operations

To adequately fulfill its duties, the Bank will further strengthen the capacity of the internal organization by developing an integrated set of strategies, policies, procedures, and facilities that enable better management of its human capital. Digitalization within the internal organization should promote efficiency and enable better insight into the business. Additionally, as the Central Bank of Suriname, Information Security remains a strategic focus to ensure the confidentiality, availability, and integrity of our own data.

Strategic Goals and Projects

To achieve strategic pillar 4, the following strategic projects are being implemented:

- Documenting and implementing “best practices” in finance

- Projects:

- 9.1 Optimize the financial function by implementing best practices and International Financial Reporting Standards (IFRS).

- 9.2 Determine the optimum amount of the Bank’s capital and distribution key of the result and recapitalization.

- Projects:

- Strengthening the financial position of the Bank

- Project:

- 10.1 Setting up a Treasury Function.

- Project:

- Digitizing the information flow

- Projects:

- 11.1 Implementing a data integration, reporting & management information platform for the Bank.

- 11.2 Expand the document management system.

- Projects:

- Implementing international IT control & security standards

- Projects:

- 12.1 Implementation of Enterprise IT COBIT 5.

- 12.2 ISO 27001 certification for Payment Systems.

- Projects:

- Targeted and systematic classification of employees according to function groups

- Projects:

- 13.1 Implementing an updated job classification and salary structure throughout the Bank.

- 13.2 Developing and implementing a policy for professional development, training, and succession planning (Human Resource Development strategy).

- 13.3 Formulating and implementing a culture change program.

- 13.4 Formulating and implementing a long-term housing plan.

- Projects:

Pillar 5: Governance

In support of our vision to be an autonomous monetary and financial authority, the Bank has set the implementation of good governance throughout the organization as a strategic priority. Increased levels of disclosure and transparency are integral to improving governance and financial management for central banks, as well as for the wider financial community. We, as the Central Bank, will lead by example, focusing on adopting sound corporate governance practices captured in our own Code of Governance.

Strategic Goals and Projects

To achieve strategic pillar 5, the following strategic projects are being implemented:

- Developing a corporate governance structure based on international standards

- Projects:

- 14.1 Formulate and implement the Code of Governance for the Bank and Supervisory Board.

- 14.2 Define and set up an Internal Audit function.

- 14.3 Strengthen risk management and set up the risk management function.

- 14.4 Establish the Internal Audit Committee by the Supervisory Board.

- 14.5 Set up the Compliance function.

- Projects:

- Documenting processes throughout the Bank and reviewing, developing, and implementing procedures for procurement

- Projects:

- 15.1 Document the Bank’s business model and the associated processes at multiple levels.

- 15.2 Improve, develop, and implement the procurement policy for goods and services based on best practices.

- Projects:

Pillar 6: Communication

More than ever, the Bank will have to explain its strategic direction to both its internal and external stakeholders. Providing reliable information and insights contributes to predictability, minimizing or weakening inaccurate and negative influence. By communicating its policy in a constructive and proactive manner, the Bank aims to turn every staff member into an ambassador and create support within society.

Strategic Goals and Projects

To achieve strategic pillar 6, the following strategic projects are being implemented:

- Developing and implementing a professional public relations and communication policy

- Projects:

- 16.1 Formulate and implement a communication strategy.

- 16.2 Create awareness of the Bank’s field of work, its business model, and other aspects of central banking among all stakeholders.

- 16.3 Develop and implement media policy and media communication protocols.

- Projects:

- Developing a “Corporate Social Responsibility” strategy

- Project:

- 17.1 Establishing and implementing the “Corporate Social Responsibility” strategy.

- Project:

Pillar 7: Sustainable Economic Development

In addition to its primary tasks of promoting monetary and financial stability, the Bank takes on the task of promoting balanced socio-economic development in Suriname. As the Central Bank of Suriname, we will have a leading role as an incubator for the areas required for a transformation to sustainable economic development. As a knowledge institute, the Bank will assist in developing the necessary capacity and financial infrastructure. The Bank will contribute to developing the right preconditions for economic growth and the development of society.

Strategic Goals and Projects

To achieve strategic pillar 7, the following strategic projects are being implemented:

- Stimulating sustainable socio-economic development through capacity building and financial infrastructure

- Projects:

- 18.1 Institutional capacity building: setting up the Central Bank Academy (CBA).

- 18.2 Institutional capacity building: Financial Intelligence Department (FID).

- 18.3 Setting up the Strategic Investment Department (SID).

- 18.4 Create and manage sustainable Funds.

- 18.5 Strengthening the financial infrastructure: financial market supervision.

- 18.6 Strengthening the financial infrastructure: setting up an (electronic) stock exchange.

- Projects:

Implementation Approach

The Bank’s Strategic Plan is ambitious and requires a program- and project-based approach for implementation, which will be centrally coordinated. A significant number of projects require collaboration within and across directorates and will therefore be executed by multidisciplinary project teams. Projects are owned by one of the Directors. Project managers receive the mandate for managing the project and report to the Board of Directors.

Based on the monitoring cycle (see appendices), the Bank’s strategy will be evaluated by the Directors every six months. In this evaluation, the high priorities for the short, medium, and long term will be identified.

Appendices

Monitoring Cycle

The Bank will implement a monitoring cycle with the following components:

- Monthly project updates: All project teams provide monthly updates on the progress of their projects to the Board of Directors.

- Quarterly reviews: Every three months, the Board of Directors will meet to review the overall progress of the Strategic Plan, discuss any challenges, and make adjustments as necessary.

- Annual evaluation: At the end of each year, a comprehensive evaluation of the Strategic Plan will be conducted to assess the achievement of strategic goals and make necessary revisions for the following year.

Bron:

Link:

Interne Link:

Tags: