Financial Inclusion and FinTech in Suriname

Related Cases:

-

8 Oct 2024

Shreshta Chotelal, Marla Dukharan, Jeetendra Khadan, Melissa Marchan

Cataloging-in-Publication data provided by the Inter-American Development Bank

Felipe Herrera Library

Financial Inclusion and FinTech in Suriname / Shreshta Chotelal, Marla Dukharan, Jeetendra Khadan, Melissa Marchand.

p. cm. — (IDB Technical Note; 2426)

Includes bibliographic references.

- Business enterprises – Social aspects – Suriname.

- Financial institutions – Technological innovations – Suriname.

- Financial services industry – Technological innovations – Suriname.

- Banks and banking – Technological innovations – Suriname.

- Electronic funds transfers – Suriname.

- Finance – Government policy – Suriname.

I. Chotelal, Shreshta.

II. Dukharan, Marla.

III. Khadan, Jeetendra.

IV. Marchand, Melissa.

V. Inter-American Development Bank. Country Office in Suriname.

VI. Series. IDB-TN-2426

Copyright © Inter-American Development Bank. This work is licensed under a Creative Commons IGO 3.0 Attribution-NonCommercial-NoDerivatives (CC-IGO BY-NC-ND 3.0 IGO) license (legalcode) and may be reproduced with attribution to the IDB and for any non-commercial purpose. No derivative work is allowed.

Any dispute related to the use of the works of the IDB that cannot be settled amicably shall be submitted to arbitration pursuant to the UNCITRAL rules. The use of the IDB’s name for any purpose other than for attribution, and the use of IDB’s logo shall be subject to a separate written license agreement between the IDB and the user and is not authorized as part of this CC-IGO license.

Note that the link provided above includes additional terms and conditions of the license. The opinions expressed in this publication are those of the authors and do not necessarily reflect the views of the Inter-American Development Bank, its Board of Directors, or the countries they represent.

Financial Inclusion and FinTech in Suriname

Shreshta Chotelal, Marla Dukharan, Jeetendra Khadan, and Melissa Marchand

Abstract

This paper examines the potential role FinTech can play in supporting Suriname’s financial inclusion efforts. Financial technology—or “FinTech”—describes the integration of technology into financial services to improve their use and delivery to customers. More importantly, it has the potential to meet the needs of population segments that are not the main target of traditional financial service models.

FinTech applications include mobile banking, mobile money, point-of-sale solutions, e-commerce, and digital currencies. These innovations have contributed to financial inclusion, fostering financial development, economic growth, poverty reduction, and socioeconomic development.

We find that Suriname is making progress in promoting the development and use of FinTech. However, there is room for further improvement, particularly in fostering an enabling environment to harness FinTech opportunities, strengthening broader financial sector policies, addressing potential risks, promoting international collaboration, and tackling critical country-specific challenges.

JEL Codes: G1, G21, H6, O1, E5, E6

Key Words: financial access, financial deepening, financial inclusion, financial sector development, FinTech, Suriname.

2. Socioeconomic Context

a. Macroeconomic Performance

Following a robust run of strong economic growth from 2001–2013, Suriname’s economy has struggled to achieve meaningful growth since 2013 and is now in its second recessive cycle in the last six years. Commodities, primarily gold and oil, account for roughly 80 percent of total exports and provide 25–35 percent of the government’s revenue, making the country highly susceptible to commodity price and domestic output shocks. The strong growth from 2001–2013, which averaged 4.7 percent annually, was primarily based on high commodity prices and increased output from the mining and oil sectors. Suriname’s economy was severely affected by gold and oil prices collapsing in 2014 (see Khadan, 2020a). The economic deterioration in 2014 was further compounded by the collapse in alumina prices in late 2015, prompting Alcoa to shut its Suralco alumina plants, driving exports even lower and further eroding fiscal and external balances (IMF, 2016; Khadan, 2018; Khadan 2021). Fiscal tightness in the context of an adjustment program dampened economic activity, and the economy shrank in 2015 and 2016 (see Khadan, 2020b). Stabilization of the exchange rate and inflation, coupled with an expansion in gold production, saw the economy return to growth in 2017–2019. But this upturn did not last. The spread between the official exchange rate and the ‘black market’ rate widened as fiscal and external deterioration accelerated and growth slowed—all before the global economic shock from the COVID-19 epidemic. These pre-existing weaknesses put Suriname’s socioeconomic stability at greater risk when the COVID-19 shock (and its ongoing aftershocks) hit.

The economic contraction in 2020 was estimated at 15.9 percent, as the new political leadership began another cycle of macroeconomic adjustments amidst the global pandemic (Figure 1). Suriname’s currency depreciated by almost 90 percent in 2020: from SRD7.52: USD1.00 at the end of August 2020, where it had remained practically stable for 26 months, to SRD14.29: USD1.00 by the end of October 2020. Furthermore, on June 7, 2021, the Central Bank of Suriname (CBvS) transitioned to a new monetary policy framework with a reserve money targeting regime and a floating exchange rate system. Both Standard & Poor’s and Fitch Ratings downgraded Suriname to default status. Fitch Ratings downgraded Suriname’s Long-Term Foreign-Currency Issuer Default Rating (IDR) to ‘RD-restricted default’ from ‘C-distressed’ in April 2021. Standard & Poor’s Ratings also downgraded Suriname’s long-term foreign currency sovereign credit rating to ‘SD-selective default’ from ‘CCC-currently vulnerable’ and the issue-level rating on the 2026 bonds to ‘D-default’ from ‘CCC’ in November 2020. The downgrades came after the government missed a coupon payment of US$25 million on the 2026 bond in October 2020 and proposed a standstill on the repayment on its two international bonds. After negotiating with bondholders, the government received the requisite consent to defer debt service payments that were originally due during October–December 2020 on the 2023 and 2026 notes until July 31, 2021.

After almost 14 months of negotiations, the IMF approved a 36-month arrangement under the Extended Fund Facility (EFF) for Suriname, in an amount equivalent to SDR472.8 million (about US$688 million or 366.8 percent of quota) on December 22, 2021. The EFF program and support from other international development partners will help support the country’s economic recovery plan.

b. Financial Sector

I. Overview

As of December 2019, Suriname’s financial sector comprised ten commercial banks, 13 insurance companies, 19 credit unions, 33 pension funds, 31 money exchange offices and money transfer companies, and six financing companies. The state plays a significant role in providing financial services—three banks are 100 percent state-owned, one (Hakrinbank) is 51 percent state-owned, and another (De Surinaamsche Bank) is 10 percent state-owned. Commercial banks constitute the largest part of the financial sector, accounting for 75 percent of financial sector assets, which has remained stable over the last decade. Of the ten licensed commercial banks, nine are operating, with Volkscredietbank (VCB) and Landbouwbank (LLB) licensed separately but operating as one entity. The total number of financial institutions participating in the sector has declined over the last 15 years, mainly due to a decline in credit cooperatives. However, the number of licensed commercial banks has increased from seven to ten.

II. Financial Sector Performance

Financial soundness: Financial soundness indicators deteriorated in 2020 even before the SRD depreciation in September 2020 and are expected to be further impacted similarly to the last cycle of macroeconomic adjustment in 2015–2016. The banking system was sufficiently capitalized to absorb losses and remain liquid in June 2020, with a Tier 1 capital ratio of 10.8 percent (see Table 1). However, the impact of the most recent SRD depreciation is expected to affect balance sheets at least as much as the prior depreciation episode, as observed in June 2016 data (see IMF, 2016). Asset quality deteriorated in H1 2020—not unique to Suriname in the context of the global pandemic and containment measures (see Table 1). However, the non-performing loan (NPLs) to gross loan ratio has not returned to single digits since the last economic shock and adjustment began in 2015 (see Table 1). This pre-existing condition rendered the banking system even more vulnerable going into the pandemic. Banks’ earnings and profitability have been highly volatile. The banking sector’s return on assets (ROA) averaged 1.2 percent over the past 25 quarters ending in June 2020 and only dipped to 1 percent once in the last four years. Return on equity (ROE) has seen significant volatility and was particularly affected following the previous devaluation, high inflation, and economic contraction in 2016. Though results had recovered in 2019, they began to weaken again in H1 2020 (Table 1).

Financial Sector Depth: Considerable empirical evidence suggests that a deep financial sector plays an important role in economic development (Ross et al., 2005). Empirical studies have illustrated that higher levels of financial development are associated with lower levels of inequality (Čihák et al., 2012). In addition to driving economic growth, financial sector development plays an important role in poverty reduction by supporting entrepreneurship and increasing investment activity. The literature has found diminishing marginal returns to GDP growth from private sector credit and even negative returns when the two variables converge, i.e., as private sector credit approaches 100 percent of GDP (Arcand et.al, 2015). Suriname, however, remains far from this threshold, leaving ample space for financial sector deepening to promote economic development. The CBvS Depth Index (Ong-A-Kwie-Jurgens, 2014), which tracked the average size of the financial system relative to GDP at 32.6 percent from 1990 to 2014, suggests that the financial system is shallow. From 2015–2017, this indicator averaged 31 percent of GDP for Suriname.3 Figure 2 benchmarks this figure against the averages for other economies for the 2015–2017 period, revealing that Suriname’s financial depth is lower than that of different regions and developing economies. Based on the author’s calculations from data from the CBvS and General Bureau of Statistics (Algemeen Bureau Voor de Statistiek (ABS), 2020), this measure averaged 31.9 percent between 2017 and 2019 for Suriname.

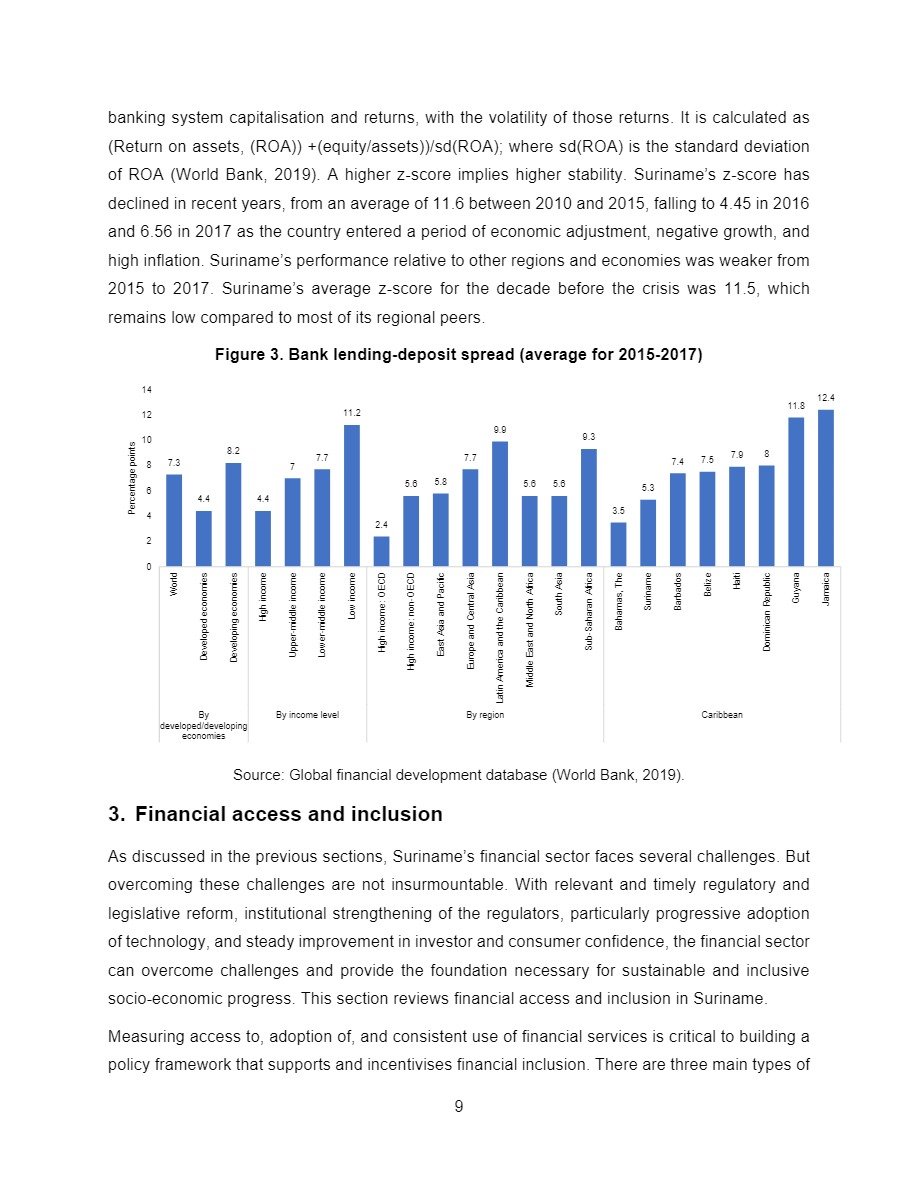

Financial Sector Efficiency

Financial efficiency measures reflect how well a financial system delivers financial services by looking at variables such as costs of intermediating credit and profitability. The Global Financial Development Report uses the bank lending-deposit spread as the leading means of assessing efficiency. The lower the spread between loan and deposit interest rates, the more efficient the financial system. For Suriname, the loan-deposit spread has averaged 5.25 percentage points between 2008 and 2017, down from an average of 12.6 percentage points from 2000 to 2005 (Figure 3). Using this indicator, Suriname’s financial sector efficiency compares well within the region and globally. Profitability is another measure that can be used to determine efficiency. However, the high volatility associated with banks’ return on assets and return on equity during recent economic shocks, as discussed earlier, suggests that profitability may not be an appropriate measure for Suriname.

The Central Bank of Suriname (CBvS) constructed a financial development index in 2014 (see Ong-A-Kwie-Jurgens, 2014) to examine the relationship between financial sector development and economic growth. The findings suggested inefficiencies in channelling funds to private sector creditors—a possible consequence of government crowding out, weak financial sector competitiveness, lack of economies of scale, high operating costs, and high inflation. This is also the result of the economic structure: a small, open, commodity-dependent economy primarily funded by foreign direct investment, and therefore has limited opportunities and effects on the domestic financial services sector.

Financial Sector Stability

Financial institutions must be sufficiently capitalised and liquid to withstand domestic and external shocks and contagion. A stable financial system underpins efficient financial intermediation by creating an environment that engenders confidence, supports savings, mobilises investment, and promotes growth. The financial sector’s ability to withstand shocks is largely determined by its capital adequacy, asset quality, and liquidity ratios. Typically, the stability index has the largest impact on economic growth. In Suriname, the growth impact is subdued since the financial sector remains underdeveloped in terms of the number of participants and total asset size relative to GDP. The CBvS found that the efficiency and stability indices have an impact on economic growth in the long term, indicating that a 1 percent rise in the efficiency or stability indices is associated with GDP growth of 0.14 percent (efficiency index) and 0.44 percent (stability index) in the following period.

In prior episodes of high inflation caused by monetary financing of fiscal deficits, investment suffered as the deposit base in the financial system shrank. The turning point did not come until macroeconomic stability (and confidence) returned. Stability can also be assessed using the banking system’s z-score, which compares the banking system’s capitalisation and returns with the volatility of those returns. It is calculated as:

where sd(ROA) is the standard deviation of ROA (World Bank, 2019). A higher z-score implies higher stability. Suriname’s z-score has declined in recent years, from an average of 11.6 between 2010 and 2015, falling to 4.45 in 2016 and 6.56 in 2017 as the country entered a period of economic adjustment, negative growth, and high inflation. Suriname’s performance relative to other regions and economies was weaker from 2015 to 2017. Suriname’s average z-score for the decade before the crisis was 11.5, which remains low compared to most of its regional peers.

Financial Access and Inclusion

As discussed in the previous sections, Suriname’s financial sector faces several challenges. But overcoming these challenges is not insurmountable. With relevant and timely regulatory and legislative reform, institutional strengthening of the regulators—particularly progressive adoption of technology—and steady improvement in investor and consumer confidence, the financial sector can overcome challenges and provide the foundation necessary for sustainable and inclusive socio-economic progress. This section reviews financial access and inclusion in Suriname.

Measuring access to, adoption of, and consistent use of financial services is critical to building a policy framework that supports and incentivises financial inclusion. There are three main types of indicators to consider when measuring financial inclusion:

- Access to financial services

- Usage of financial services

- Quality of the products and the service delivery (World Bank, 2015)

The CBvS has gathered supply-side data to measure access to financial services, including access to physical infrastructures, such as bank branches, technology for the use of financial services such as Automated Teller Machines (ATMs), and point-of-sale availability of different financial services through financial institutions.

According to data reported in the IMF’s Financial Access Survey (International Monetary Fund, 2020), the number of depositors with commercial banks per 1,000 adults in Suriname reached 1,477 in 2019, up 36 percent since 2015—a value of over 1,000 indicates that people have more than one deposit account. This is the second highest in Latin America and the Caribbean, following Colombia. The number of depositors with credit unions and credit cooperatives per 1,000 adults was 39 in 2018—a sharp drop from the high of 185 in 2009. However, access to deposit accounts does not guarantee access to other financial services.

The number of borrowers from commercial banks per 1,000 adults in Suriname has shown a 6 percent improvement since 2015 but remains low at 198 compared to an average of 293 for Latin America. The number of borrowers from credit unions per 1,000 adults in Suriname was 4.5 in 2019. The data reveal significant overall growth in the number of deposit accounts both at banks and savings and credit cooperatives in Suriname.

In recent years, improvements have also been recorded in providing a greater number of points to access banking services, as shown below. The Bankers Association of Suriname estimated in October 2019 that the number of Point of Sale (POS) systems had grown to reach 4,150, with 420,000 debit cards in the hands of the Surinamese population (Frangie, 2019). Financial access for adults, as measured by the number of bank branches per 100,000 adults, is lower in Suriname than its expected median, according to the FinStats Dashboard (World Bank, 2019). The data show that little progress has been made towards improving this figure over the last decade (Figure 4). Compared to other IDB Borrowing Member Countries (BMCs) in the Caribbean, Suriname outperforms Guyana and Jamaica in this indicator while lagging behind the remaining BMCs, suggesting considerable room to expand access (World Bank, 2019; International Monetary Fund, 2020).

Compared to a broader cross-section of peers from the Americas, Suriname is aligned in terms of the number of ATMs per 100,000 adults, though still falling behind in terms of commercial bank branches per 100,000 adults. Geography poses a significant constraint to the availability of financial services in Suriname, with sparsely populated areas distant from the nation’s most important economic centers. Access to financial services is thus inequitable, which can play a role in generating inequality between the commercial centers and the rest of the country. Suriname has the lowest population density in the region, at 3.7 persons per km². As a result, it falls far behind regional peers in commercial bank branches and ATMs per 1,000 km².

Access to financial services for business: In the 2018 World Bank Enterprise Survey, 25.9 percent of firms in Suriname cited ‘access to finance’ as their biggest obstacle. This was up from 15.9 percent of firms in 2010. A deeper look at the data reveals that 93.5 percent of firms have a checking or savings account—91.4 percent for small businesses (5–19 employees), 97.7 percent for medium businesses (20–99 employees), and 100 percent for large businesses. However, the gap in access to credit is wider. Moreover, the 2021 Innovation, Firm Performance, and Gender (IFPG) survey found that access to digital payment systems became the third most important constraint to doing business in Suriname during the pandemic.

Noticeable gaps are also present between firms managed by women versus men across all major financial service access indicators, particularly credit. Only 26.3 percent of firms whose top manager is a woman have a bank loan or line of credit, versus 38 percent of firms managed by men. This is despite higher demand for loans by firms run by women, with only 31.6 percent reporting they do not need a loan, compared to 44.7 percent for male-run firms. Women-run firms were 1.4 times more likely than male-run firms to identify access to finance as a major constraint. The data also reveals differences in usage patterns, which warrants deeper evaluation beyond the scope of this study to determine the specific barriers and how they can best be addressed. Women-run companies are less likely to use banks to finance investments, working capital, and trade finance, such as supplier/customer credit terms.

Differentiation in the level of access between sectors is also noted, with food manufacturers having the lowest proportion of firms with a checking or savings account, at 87 percent. Regarding access to credit, the “other manufacturing sectors” had the lowest proportion of firms with a bank loan or line of credit, at 25.8 percent. Overall, 14.3 percent of firms reported access to finance as a major constraint to doing business. Moreover, 51.8 percent of firms use banks to finance investments, with notable differences across sectors. For instance, 70.3 percent of food manufacturers use banks to finance investments, while only 28.5 percent of “other manufacturers” do so; the latter frequently turn to internal financing. Whereas 62.6 percent of investments by large businesses (100+ employees) are financed by banks, this is true for only 20.1 percent of the investment by small businesses (5–19 employees).

Access to financial inclusion can be limited by the availability of resources required to use the services, such as mobile phones, internet, or Know-Your-Customer (KYC) requirements, such as a utility bill in the account holder’s name. Trust, cultural, and social norms can also play a limiting role in financial inclusion. Inequality could be deepened by the existing digital divide, where access to the internet, mobile phones, or computers is uneven. In Suriname, around 32 percent of the population over the age of 18 does not hold a bank account, according to data from the Surinamese Bankers Association (SBV). Citing FinaBank Market Research, the SBV points to the following reasons for financial exclusion:

- No permanent job (44.3 percent)

- No proof of employment and payslip (18.7 percent)

- No confidence in the banking system (2.4 percent)

- Unfamiliar with the benefits of banking (6.5 percent)

High collateral requirements can also be a constraint to credit access. On average, the 2018 World Bank Enterprise Survey found that 88.4 percent of loans in Suriname required collateral. The collateral value needed for business loans averaged 241.5 percent of the loan amount across all sectors, reaching 300 percent for the retail sector.

Voluntary exclusion from financial services is another important constraint to deepening financial inclusion. A 2020 IDB Telephone Survey conducted in Suriname points to a statistically significant relationship between financial literacy and investing (including demand deposits, time deposits, savings deposits, foreign currency deposits, etc.) in Suriname. The most significant variables influencing financial investment decision-making were financial literacy and income level, highlighting the importance of improving basic financial knowledge to limit voluntary exclusion. Factors such as age, gender, household size, risk perception, and education level were found to have no relationship with decisions on investing. The result underscores the importance of a national financial inclusion strategy for Suriname.

4. FinTech as an Enabler for Financial Inclusion

FinTech combines financial services and solutions based on technologies. Even though the economic literature does not agree on a single definition of FinTech (Nicoletti, 2017; Magnuson, 2019), it broadly describes FinTech as any innovation related to how businesses seek to improve the process, delivery, and use of financial services (Mention, 2019). This innovation can take many shapes and forms, such as new business models, applications, processes, or new products. In that regard, FinTech is not new. Commercial banks, in particular, have been applying financial technology for centuries: from the issuance of the first cheques in the Middle Ages, the large-scale introduction of credit cards in the 1950s, to the execution of an ‘instant payment’ in the 21st century (Buckley, Arner, and Barberis, 2016). However, in recent years, the investment in financial technology and the pace of innovation have increased sharply, giving non-banking parties—both young FinTech start-ups and large, big technology companies—an opportunity to enter the financial market. Until recently, banks were ‘sole rulers’ in offering and providing most financial services; there are now new players throughout the banking value chain. Various applications of blockchain technologies, artificial intelligence and machine learning, new digital advisory and trading systems, peer-to-peer lending, equity crowdfunding, digital KYC processes and regulatory technology, mobile money, e-wallets, and other mobile payment systems are all examples of innovations that are central to FinTech in today’s world.

The COVID-19 pandemic highlighted the importance of FinTech as it provides alternatives that allow for safer transactions, in line with pandemic protocols and safety measures, such as cashless payments and contactless transactions. But the potential of FinTech encompasses much more than providing safer transactions. FinTech has the potential to enable financial inclusion because it makes financial services more accessible and often at a lower cost for both providers and consumers, focusing on the underserved individuals and communities (the bottom of the pyramid). This will be of particular benefit to Suriname’s remote communities and geographically dispersed population. FinTech also promises greater economies of scope, broadening access to products such as savings, payments, and credit by reducing information asymmetries for both consumers and financial service providers. By offering greater convenience, lower transaction costs, and better credit risk assessments, FinTech has the potential to increase the number of participants in financial markets and help lessen the urban-rural access inequalities.

Furthermore, FinTech can promote integrity in public finances and improve efficiency, such as in the issuance of electronic tax invoices and registration of tax payments, as well as payment of other government services. It provides opportunities for faster and more efficient deployment of government aid, and in the case of Suriname, this is true, particularly in the more remote and sparsely populated interior. For example, Suriname’s distribution of social benefits payments is often done in cash that gets transported to the areas by trucks or boats, which presents multiple risks, including security and lack of verification mechanisms to ensure the intended beneficiaries receive payments. Distribution via FinTech solutions could provide benefits in terms of transparency, mainly where the institutional capacity to monitor billing practices is low.

4.1 State of FinTech Initiatives in Suriname

FinTech initiatives in Suriname have primarily emerged from traditional financial institutions (banks) employing new technologies or partnering with FinTech and Information Technology (IT) companies to develop and deliver new products. Most banks in Suriname are engaged with FinTech one way or another. The majority remain principally focused on applications of FinTech in payments (such as internet banking, mobile banking, mobile point-of-sale devices, and e-wallets). However, some are venturing out, trying to adopt FinTech across the entire value chain, from setting up e-commerce platforms to using artificial intelligence to improve customer service and drive greater workforce productivity. A few examples of recent FinTech initiatives in Suriname are:

- E-wallets or digital wallets such as Uni5Pay+ and Mopé: Uni5Pay+ and Mopé provide services to both the banked and unbanked. Although an individual’s existing bank account can be linked to both Uni5Pay+ and Mopé, having a bank account is not mandatory as top-up through physical locations is facilitated. Furthermore, e-wallets enable online customer onboarding and KYC by linking the national electronic identification card (E-ID), national identification card (ID), passport, or driver’s license to the e-wallet. This provides opportunities to authenticate the holder’s credentials. For example, an e-wallet could verify the buyer’s age at the store while purchasing alcohol. The more verification data a customer can provide, the more access they have to different services, transaction types, or transaction amounts. Adoption is incentivized by offering utility payments (water, electricity, mobile top-up, etc.) as part of the suite of services. Mopé provides an extra service in the form of a debit card linked to the e-wallet. This debit card can be used as a regular debit card issued by the bank. The goal of the Mopé debit card is to promote financial inclusion without the need to open a bank account. The Mopé debit card also targets employers, who could request the debit card for their employees to deposit their salaries, providing opportunities for the informal sector. Parents could also request the debit card for their children. Furthermore, Mopé is linked with iDeal in The Netherlands, enabling anyone with a Dutch bank account to transfer Euros directly to a Mopé wallet in Suriname or top up their Mopé mobile wallet for use in Suriname. Transferring Euros from The Netherlands to a Mopé wallet costs up to 60 percent less than transferring via money transfer companies and approximately 90 percent less than a regular foreign transfer from The Netherlands to Suriname. This provides opportunities for remittances and conducting transactions with the country’s largest diaspora market.

However, the adoption rate of businesses towards the e-wallet systems could be better. Around 300 organizations are connected to the payment system of Uni5Pay+, and Mopé has about 400, according to data from Uni5Pay+ and Mopé. According to the business register of the Chamber of Commerce in Suriname, there were 32,814 registered organizations in Suriname in 2019. This means that approximately 1 percent of the organizations in Suriname have subscribed to these systems.

A few strategies could be considered to drive the broad adoption of these FinTech tools. For example, building a network of “cash-in” agents will be critical to bringing enough money into the digital ecosystem to facilitate payments by large users. For instance, distributors in Paramaribo transfer goods to other districts in the country. The merchants buying these goods from the distributor for resale would need to have received enough “digital payments” through their business activities to pay the distributor digitally. Another way to quickly drive broad adoption is for the government to seed the network by disbursing its payments for social welfare and other benefits, salaries, health services, etc., using digital wallets. This would drive adoption and frequent usage and engender trust in the network.

- E-commerce platforms: HOPPA, another FinTech product provided by Hakrinbank N.V., is an e-commerce platform that offers business-to-business, retail-to-retail, wholesale-retail, and business-to-consumer options. Purchased products can be delivered, and payments can be made through local debit cards, Mopé, POS on delivery, or iDeal. By linking iDeal to this platform, people in The Netherlands can purchase goods on HOPPA and get them delivered to family and friends in Suriname. Some vendors on the platform also provide the possibility to have products delivered in The Netherlands. These e-commerce platforms open borders for Surinamese businesses to access the foreign market, especially SMEs, who do not always have the means to create their own webshop and foreign distribution channel, could benefit from this.

5. Harnessing the Benefits of FinTech

To accelerate financial inclusion, the World Bank and the IMF launched the Bali FinTech Agenda in October 2018. The Bali FinTech Agenda comprises 12 high-level principles to help countries develop policies that benefit from FinTech while mitigating risks. It also provides a framework to support the Sustainable Development Goals, particularly in low-income countries where access to financial services is low. The 12 principles can be grouped into four objectives: (i) fostering an enabling environment to harness opportunities; (ii) strengthening the financial sector policy framework; (iii) addressing potential risks and improving resilience; and (iv) promoting international collaboration. In the rest of this section, we examine these four objectives in the context of Suriname.

5.1 Fostering an Enabling Environment to Harness Opportunities

The focus of this first objective of the Bali FinTech Agenda is, among others, on developing the necessary financial and information and communications technology (ICT) infrastructure and improving literacy rates so FinTech can be leveraged to advance financial sector development. In this regard, access to and availability of foundational infrastructure, the affordability of technology, and digital and financial literacy in Suriname are analyzed below.

(i) Access to and Availability of Foundational Infrastructure

Foundational infrastructure refers to the basic infrastructure needed to support the development and adoption of FinTech, such as access to and reliability of electricity, mobile, and broadband internet services. We examine the state of these services for Suriname below.

Electricity: There are differences in access to electricity between the urban and rural areas in Suriname. The national electricity access rate is 96.8%, with 99% access in urban areas and 91% access in rural areas. Furthermore, remote communities (for example, interior villages) are underserved and lack reliable provision. These communities usually have electricity for six hours per day or less, and the costs are also much higher as electricity is mainly provided through diesel generators. The country needs to continue implementing rural electrification projects to close this gap. In terms of reliability, the 2018 World Bank Enterprise Survey showed that almost one-third of firms identified electricity as a major or very severe obstacle to their business operations. For instance, 88.2% of firms experienced power interruptions, with a frequency of power outages between 1-3 times in a typical month.

Mobile Connectivity: Suriname performs relatively well in mobile connectivity. The internet and smartphones have opened new avenues for FinTech, serving as essential enablers for the industry. Mass-market penetration of smartphones has enabled internet access for millions of people worldwide, positioning mobile technology as a gateway to financial services and financial information and education. According to data from the International Telecommunications Union (ITU), there were 813,844 mobile telephone subscriptions in Suriname at the end of 2019—equivalent to 140 per 100 population—with the total number of subscriptions more than doubling since 2007. However, the penetration of mobile devices has receded in recent years from a high of 927,800 in 2014 (168 per 100 population). This contraction was sharper than in other countries in the region, although Suriname’s cellular penetration remains higher than other Caribbean countries. Jamaica has 103 subscriptions per 100 inhabitants, The Bahamas 109, Barbados 115, and Trinidad and Tobago 155. Suriname also has one of the highest active mobile internet subscriptions within the Caribbean region. Approximately 91 people per 100 population had an active mobile internet subscription in 2019 compared to 93 in The Bahamas, 42 in Barbados, 55 in Jamaica, and 49 in Trinidad and Tobago.

Broadband Connectivity: Broadband (or high-speed) internet access has become necessary for economic and human development in developed and developing countries. It is also an important facilitator of FinTech. Unfortunately, fixed-broadband subscriptions are relatively low in Suriname compared to mobile phone penetration. The country has 13.82 fixed-broadband subscriptions per 100 inhabitants, which is one of the lowest in the Caribbean region. Barbados scores the highest with 37.21 subscriptions per 100 inhabitants. Additionally, there is a digital divide between urban and rural areas in terms of access to high-speed internet. Currently, there is no broadband connectivity in the interior of Suriname, while broadband has been rolled out in some coastal regions.

(ii) Affordability of Technology

The World Economic Forum’s Networked Readiness Index (NRI), also referred to as the Technology Readiness Index, measures countries’ propensity to exploit the opportunities offered by ICT. The Index consists of 10 pillars, of which the 4th pillar assesses the affordability of ICTs in a country through indicators such as mobile telephony usage costs, broadband Internet subscription costs, and the state of liberalization of ICT services. These indicators are closely linked to the affordability of FinTech, as FinTech uses ICT infrastructure to reach its target groups.

In 2015, Suriname ranked 119 out of 143 countries on the affordability pillar, with a score of 3.4 on a scale from 1 to 7, a sharp contrast compared to other Caribbean countries. Trinidad and Tobago was positioned at number 52 with a score of 5.7; Jamaica at 71 with a score of 5.3; Barbados at number 100 with a score of 4.3; and Guyana ranked 102 with a score of 4.2.

Considering the costs of setting up ICT infrastructure in Suriname, the further you move away from coastal areas, the higher the costs due to forest density and lack of road access, especially in the interior. For example, whereas a standard mobile tower may cost approximately US$400,000, a tower placed in the interior under the aforementioned conditions could be as much as five times more expensive.

When analyzing affordability from the customer perspective, poverty levels and inequality are useful indicators to consider. The overall poverty rate for Suriname is 26 percent, but rates are much higher in rural areas. Furthermore, the ongoing pandemic and macro-economic crises could increase poverty and inequality.

(iii) Digital and Financial Literacy of the Population

A basic level of digital and financial knowledge is needed to access and use FinTech products and services, especially to increase financial resilience. Digital and financial literacy also enable individuals to voice their needs better, which helps providers target their products and services more effectively. Financial literacy has been shown to improve households’ financial resilience, enabling people to better plan, save for retirement, and accumulate more wealth. The results of an IDB telephone survey on financial literacy in 2020 showed that Suriname has relatively high levels of financial literacy by international standards. The financial literacy index for Suriname is 1.92 compared to 1.65 for Barbados and 1.73 for the United States (USA). However, there are significant differences among demographic groups. Suriname’s extremely poor and poor scored 1.50 and 1.55, respectively, while the non-vulnerable group scored 2.11. Notable differences were also recorded among professions, with agricultural workers scoring 1.66, government employees, and non-governmental and international organizations scoring 2.16. Similar differences were noted between those with primary education (1.63) versus higher education (2.34) and by age groups: 60 years old or older (1.79) versus 30 to 40 years old (1.99). These results signal that financial literacy initiatives need to be targeted to key demographic groups, addressing issues that lead to lower financial literacy to help improve financial resilience, making the economic recovery in Suriname more inclusive.

5.2 Strengthening the Financial Sector Policy Framework

The Bali FinTech agenda’s second objective focuses on improving regulations and ensuring that these remain conducive to development, inclusion, and competition. Suriname has made advances regarding legislation and policies to facilitate the development of FinTech. The two main policies include the country’s E-government strategy and the Central Bank’s innovation hub.

The country’s E-government strategy seeks to make all government services available online, interconnect all government institutions, provide internet access to every family in Suriname, and ensure that every citizen has a secure electronic ID card. Part of these objectives is being achieved with the Telesur National Broadband Plan. Furthermore, a backup for the government’s data center has been created, as an own government network with associated data storage will be necessary for the next phase of the E-government strategy, in which the government will increasingly work paperless.

Various sub-projects of the E-government strategy were completed in 2019, such as implementing a QR payment system, allowing people to make payments via their telephone. It is now also possible to pay for utilities using these payment systems. The Government of Suriname also introduced an E-ID for its citizens in 2019 (distribution is ongoing). Legislation for digital identification in Suriname featuring biometric and electronic properties was officially adopted into law on January 23, 2019 (National Assembly of Suriname, Legislation Website, n.d.). From a financial sector perspective, an E-ID has many advantages, such as reducing the time and cost of acquiring information about customers for KYC and other due diligence processes and evaluating credit risk.

Another important step forward to facilitate the development of FinTech was the creation of an Innovation Hub by the CBvS in 2019. This Innovation Hub aims to support market participants regarding innovative financial products and services. The Innovation Hub is open to both authorized parties (parties already under the supervision of the CBvS) and new entrants. As part of the Innovation Hub, a regulatory sandbox was introduced to incentivize financial product innovation, supporting the development of products and services that may not yet be subject to current legislation in an environment that allows the CBvS to fully understand and monitor the technology’s benefits and risks before allowing the innovation to operate openly in the financial system. The UNI5Pay+ e-wallet is an initiative that was developed within the CBvS sandbox.

The CBvS also created a working group to gain insight into FinTech’s opportunities and risks for monetary and financial stability in Suriname. This working group will also contribute to implementing policies and guidelines for sustainable development and resilience of the financial sector.

Notwithstanding recent efforts, Suriname’s legislative framework requires further development to support growth in the sector. For example, the current legislation on KYC requirements could limit the adoption of FinTech solutions. Currently, full KYC is required under law for financial service providers, without distinction. While alternatives such as scaled requirements based on transaction amounts or transaction type have been permitted in the FinTech sandbox, they are not viable outside the sandbox if legislation is not changed. A solution offering KYC clearance associated with the digital ID could help lower compliance costs for FinTech and traditional financial service providers. Having a sound legal framework is critical, as it can help to improve trust in financial products and services.

5.3 Addressing Potential Risks, Improving Resilience, and Promoting International Collaboration

The last two objectives of the Bali FinTech Agenda are focused on dealing with the potential risks of FinTech, addressing challenges to financial integrity, consumer protection, and financial stability; and also, the need for close international cooperation and coordination to address regulatory gaps and prevent the potential risk of a race to the bottom in regulatory compliance, including Anti-Money Laundering/Countering the Financing of Terrorism (AML/CFT) compliance and the spread of global systemic risks. In this section, we examine some of these issues related to Suriname.

Trust and Risks: Financial exclusion and more so digital financial exclusion are sometimes voluntary. Some individuals in the unbanked population may voluntarily refuse to participate in the formal financial system. One of the main reasons for this refusal is trust. When individuals lack trust in the financial system, they will have little incentive to participate in the formal financial system, much less the digital financial system. The lower the level of trust, the higher the perceived risks (Ozili, 2018). This lack of trust could be due to a lack of awareness of the benefits of digital financial services, or a lack of education on how to use digital finance platforms and about the benefits and risks of digital finance services. Individuals who do not understand a product or service will not trust it and will not use it.

Cybersecurity: This is a major concern for users, as reported by the Bankers’ Association of Suriname. Suriname’s performance in the ITU’s Global Cybersecurity Index lagged the region in 2019 and was the 23rd worst-performing in the world out of 170 countries (GSMA Intelligence, 2020). The country ranked 113th out of 160 countries, according to the E-Governance Academy’s National Cybersecurity Index (E-Governance Academy, 2019). Suriname added cybercrime into its legislation but has not approved a national cybersecurity strategy, although the Government of Suriname began collaborating with the Organization of American States in late 2014. In August 2019, the Government installed a National Cyber Crime Security Committee. This committee is set up to update and implement the strategic cybersecurity plan. It is also responsible for setting up a National Computer Security Incident Response Team (C-SIRT) in Suriname.

Anti-Money Laundering/Countering the Financing of Terrorism (AML/CFT): Suriname’s 2021 National Risk Assessment (NRA) findings are important for policymakers to address. The NRA identified key money laundering/terrorist financing risks and will be critical to help the country prepare for the Caribbean Financial Action Task Force Mutual Evaluation. In that regard, the AML/CFT framework must be strengthened, with regulations requiring amendments to strengthen the legal basis for corrective action, to establish a clear reporting process for suspicious transactions, and include domestic politically exposed persons in AML/CFT rules. Technology can be critical to helping the regulator monitor risks and compliance more efficiently and streamline reporting processes to regulators.

Acknowledging the progress made by the country, there are areas for improvement with regards to a national strategy to develop robust financial and data infrastructure to sustain FinTech benefits, including addressing risks, improving resilience, and supporting trust and confidence in the financial system. Furthermore, given that FinTech is blurring financial boundaries (institutionally and geographically), international collaboration to enhance collective surveillance of the international monetary and financial systems will get increasingly important. This is because the blurring financial boundaries could amplify interconnectedness, spillovers, and capital flow volatility, which could lead to increased multipolarity and interconnectedness of the global financial system, potentially affecting the balance of risks for global financial stability.

6. Summary of Key Issues for FinTech Development in Suriname

We summarise below the main challenges and opportunities for FinTech development in Suriname:

Opportunities:

- Suriname has been making progress in developing and implementing infrastructure that can continue to support the adoption of FinTech. There are opportunities that the country can continue to build on in the short term. These include:

- (i) There is an opportunity for the government to play an important role in incentivising uptake. This can be done by offering social benefits, transfers, and subsidies through financial technologies.

- (ii) Under its E-government strategy, the government evaluates how electronic payments can improve tax administration to reduce informality and non-traceability. FinTech would offer benefits for this type of policy.

- (iii) Offering KYC clearance associated with the digital ID could help lower compliance costs for FinTech and traditional financial service providers.

- (iv) Suriname’s high mobile penetration rate provides opportunities to reach the unbanked with FinTech, particularly in the more remote and sparsely populated interior where it is not feasible for banks to open a physical branch.

Challenges:

Culture and Language: The country’s cash culture challenges the adoption of digital payments. Currently, digital payments are primarily used in the capital city, whereas economic agents in remote areas tend to rely heavily on cash. Particularly in areas where cross-border trade occurs, often informally, the adoption of digital solutions could be a challenge. Also, Suriname is multilingual, which could challenge the adoption of digital payments. While Dutch is the official language, it is not spoken by everyone. Other languages include Sranan Tongo, Javanese, Sarnami, English, and those spoken by the Maroon and Indigenous tribes. While applications do not need to be available in all spoken languages, they need to fully understand the transactions, terms of use, and risks for people to adopt the technology.

Legislation and Regulatory Framework: The legislative framework requires further development to support FinTech. Currently, some FinTech solutions are being evaluated in the Central Bank’s regulatory sandbox. However, additional investment in these solutions could be limited in the absence of a legal framework that establishes the rules for companies operating in the sector. While FinTech offers a wide range of opportunities, it also could pose a risk to financial stability and integrity. To mitigate these risks, legislative reforms will be necessary. Legal considerations should focus on:

- (i) FinTech infrastructure systems that are based on clear and legally enforceable documents,

- (ii) insolvency laws, settlement, and finality of payment that are established,

- (iii) a clear definition of how to treat balances held while being transferred and are neither in the sender or the recipient’s account (settlement risk),

- (iv) consumers and investors are protected, and competition is healthy and robust,

- (v) the legal and regulatory frameworks are sufficiently adaptive (technology-neutral) that they do not require repeated change,

- (vi) privacy concerns must be addressed to ensure the appropriate use of data collected by FinTech providers,

- (vii) compatibility and harmonisation with international law regarding cross-border cooperation, and

- (viii) cybersecurity and cyber risk are appropriately addressed.

Infrastructure: Connectivity in the interior requires investment in telecommunications and energy infrastructure. Currently, there is no broadband connectivity in the interior, while broadband has been rolled out in some coastal regions. As a result, the population in the interior has limited access to ICT services. Further, the cost of mobile communications infrastructure is very high due to limited road access and forest density.

Financial Literacy: There are significant differences among demographic groups regarding the financial literacy rate, especially the vulnerable groups who would benefit the most from financial literacy are far behind. There is a need for targeted financial literacy initiatives that address issues that lead to lower financial literacy to help improve financial resilience.

7. Conclusion

This paper examined issues relating to financial inclusion in Suriname, and the potential role FinTech can play to enhance the country’s financial inclusion efforts. The country’s current context is characterised by a severe macroeconomic crisis—high debt levels, low growth, and external and financial sector vulnerabilities. The COVID-19 pandemic exacerbated these conditions. Therefore, the financial services sector and the wider macroeconomy face risks that could be mitigated and managed through deepening in the sector, legislative and regulatory reforms, institutional strengthening, and coordination of policy objectives. In addition to structural risks, gaps in the legal framework in areas such as cybersecurity and privacy must be addressed to ensure customer protection. Some of the key risks include:

- A low-interest rate environment with high inflation creates incentives to bring forward consumption or hold hard currency. It is likely to reduce SRD (Surinamese dollar) deposits in the banking system, thus constraining credit growth and investment.

- Systemic vulnerabilities exist, including the absence of a deposit insurance system and other vulnerabilities resulting from weaknesses in crisis preparedness and resolution frameworks. Draft legislation could help to address these vulnerabilities.

- Weaknesses in the AML/CFT framework could further affect correspondent banking relationships.

- Data collection through FinTech could raise cybersecurity and privacy risks, which must be addressed through legislation and will require close supervision by the authorities.

- Gaps in the legal framework and enforcement thereof on cybersecurity, privacy, and digital lending practices could jeopardise trust and the adoption of FinTech solutions.

- The digital divide, cultural and social norms, financial literacy, safety, and access to resources, may vary between gender and constitute structural barriers that could deepen inequality with the shift toward digital financial services / FinTech solutions.

- The ecosystem in Suriname for the development of FinTech involves objectives and decisions of telecommunications and banking regulators, requiring coordination to create an environment for technologies such as mobile banking to evolve adequately.

To address these challenges and sustain the early benefits of FinTech, the country needs to prioritise robust financial and data infrastructure that are resilient to disruptions—including from cyberattacks—and that support trust and confidence in the financial system. This would help to protect the integrity of data and financial services. Such policies should be focused not only on the financial sector but also on the digital economy, including data ownership, protection, privacy, cybersecurity, operational and concentration risks, and consumer protection.

Furthermore, to ensure the success of integrating FinTech in Suriname’s financial system, attention should be given to three types of policies that are linked to an enabling regulatory environment (see Beck and Feyen, 2013 and Barajas et al., 2013):

I. Market-development policies are required to improve financial possibilities, such as legislative changes, pro-business reforms, and policies that support the country’s overall fiscal and macroeconomic performance and financial development. Such policies must deal with constraints, such as market size, which can partly be addressed through greater regional integration. Policy measures should seek to develop market infrastructures such as privacy, information sharing, and contractual frameworks to support the expansion of financial development. Reforms are necessary to deal with structural weaknesses, such as improving the ease of doing business, strengthening government safety nets, and improving the AML/CFT regime.

II. Market-enabling policies and regulatory reforms can foster greater competition and bring about efficiency gains. This includes removing regulatory impediments, reforming tax policy, and adopting measures that facilitate new entry, competition, and open/shared infrastructure (such as credit registries and payment systems and platforms). For FinTech to offer more cost-efficient solutions to the population, the regulatory and supervisory compliance processes for solutions such as mobile banking or mobile money must not become overly burdensome. The regulatory and legal frameworks can enable mobile banking to thrive or become an obstacle to its success. At the same time, the framework must weigh the risks that the system could be perceived as unsafe and must focus on creating trust. The involvement of multiple regulators such as telecommunications authorities, banking regulators, and competition authorities requires coordination to develop efficient processes that do not become excessive barriers to entry for FinTechs. A supportive regulatory environment is critical to ensuring the success of FinTech in improving socio-economic outcomes. Much can be learned from cases around the world where restrictive policy environments slowed the adoption of these technologies. Such is the case in Nigeria, where initially telecommunications firms that wanted to issue mobile money were required to be affiliated with a bank, and stringent controls of KYC that required verifying transactor information for even small amounts may have worked as a detractor to those who could have benefitted from mobile payments services. Furthermore, there were a limited number of cash-in cash-out (CICO) agents in Nigeria, making it difficult for the system to fully develop (Gutierrez and Singh, 2013; Evans and Pirichio, 2014). Regulators must ensure processes are not overly burdensome, placing additional costs on the process and deterring participation while sufficiently protecting against and mitigating the risks in the financial system to instill trust and ensure stability. This requires regulatory and supervisory bodies to build the capacities to stay up to date with technology and industry developments. To avoid risks to the integrity and stability of financial systems through rapid adoption needs assessments for resources and expertise must be prioritised by regulators and supervisory bodies.

III. Market-stabilizing policies must accompany reforms that mitigate risks arising from increased competition, particularly from nonbank financial service providers, as well as addressing risks associated with cross-border regulations, international financial integration, and AML/CFT best practices. Policies must be put in place to protect users from the risk of over-indebtedness, such as ensuring adequate financial education and literacy and consumer protection.

Despite the challenges Suriname has been (and still is) facing, the country is promoting the development and use of FinTech. As discussed, most commercial banks in Suriname are engaged with FinTech one way or another. The majority remains principally focused on applications of electronic payments; however, some are adopting FinTech across the entire value chain, from setting up e-commerce platforms to using artificial intelligence to improve customer service and drive greater workforce productivity. To advance the development and use of FinTech in Suriname, the country should focus on strengthening financial sector policies, addressing potential risks, and promoting international collaboration, as discussed in this paper.

References

- Allende Marcos, Antonio, Alleyne, Laura, Giles Álvarez, Jeetendra Khadan, and Kimberly Waithe. 2020. A Caribbean Settlement Network: Can Blockchain Ease Intra-regional Trade in the Caribbean? Inter-American Development Bank, Washington DC.

- Almarzoqi Raja, Sami Ben Naceur, and Akshay Kotak. 2015. What Matters for Financial Development and Stability? IMF Working Papers 2015/173. Washington, DC: International Monetary Fund.

- Arcand, Jean Louis, Enrico Berkes, and Ugo Panizza. 2015. Too Much Finance? Journal of Economic Growth 20 (2): 105–48. http://www.jstor.org/stable/44113443.

- Arteaga Maricruz, Diether W. Beuermann, Veronica Frisancho and Jeetendra Khadan. 2021. Financial Literacy in Suriname. Blog. Inter-American Development Bank, Washington DC.

- Barajas Adolfo, Thorsten Beck, Era Dabla-Norris, and Seyed Reza Yousefi. 2013. Too Cold, Too Hot, Or Just Right? Assessing Financial Sector Development Across the Globe. Washington, DC: International Monetary Fund.

- Buckley, Ross, Douglas Arner, and Janos Barberis. 2016. The Evolution of Fintech: A New Post-Crisis Paradigm? Georgetown Journal of International Law. 47: 1271-1319. Available at SSRN: https://ssrn.com/abstract=2676553.

- Čihák, Martin, Aslı Demirgüç-Kunt, Erik Feyen, and Ross Levine. 2012. Benchmarking Financial Systems around the World. Policy Research Working Paper; No. 6175. Washington, DC: World Bank.

- Demirguc-Kunt, Asli, Leora Klapper, Dorothe Singer, Saniya Ansar, Jake Hess. 2018. The Global Findex Database 2017: Measuring Financial Inclusion and the FinTech Revolution. Washington, DC: World Bank.

- E-Governance Academy. 2019. National Cyber Security Index. Available at: https://ncsi.ega.ee/country/sr/.

- Espinosa-Vega, Marco, Shirono Kazuko, Hector Carcel-Villanova, Esha Chhabra, Bidisha Das, and Yingjie Fan. 2020. Measuring Financial Access: 10 Years of the IMF Financial Access Survey. Departmental Papers / Policy Papers. Washington, DC: International Monetary Fund.

- Evans, David, and Alexis Pirichio. 2014. An Empirical Examination of Why Mobile Money Schemes Ignite in Some Developing Countries but Flounder in Most. Review of Network Economics, 4 (12): 397–451. https://doi.org/10.1515/rne-2015-0020.

- Fan Zhaobin and Ruohan Zhang. 2017. Financial Inclusion, Entry Barriers, and Entrepreneurship: Evidence from China, Sustainability, MDPI, Open Access Journal, vol. 9(2): 1-21.

- Fareedi Fozan, Mabel Gabrieli, Patrick Lenaini and Julien Reynaudii. 2017. Financial Inclusion and Women Entrepreneurship: Evidence from Mexico. OECD Economics Department Working Papers. OECD Publishing, Paris.

- Frangie, Eblein. 2019. Financiële inclusie en FinTech in Suriname: De roadmap voor bevordering van financiële inclusie door het gebruik van FinTech. N.p.: Surinaamse Bankiersvereniging. Available at: https://www.sbv.sr/media/1190/presentatie-e-frangie-financiele-inclusie-en-fintech.pdf.

- Giles Álvarez, Laura and Jeetendra Khadan. 2021. Mind the Gender Gap: A Picture of the Socioeconomic Trends Surrounding COVID-19 in the Caribbean with a Gender Lens. Washington, DC: Inter-American Development Bank.

- GSMA (Global System for Mobile Communications Association) Intelligence. 2020. GSMA Mobile Connectivity Index 2019. Available at: https://www.mobileconnectivityindex.com/?search=suriname#year=2019.

- Gutierrez, Eva and Sandeep Singh. 2013. What Regulatory Frameworks are More Conducive to Mobile Banking? Empirical Evidence from Findex Data. Policy Research Working Paper; No. 6652. World Bank, Washington, DC.

- IMF (International Monetary Fund). 2016. Suriname: Request for Stand-By Arrangement – Press Release; Staff Report; and Statement by the Executive Director for Suriname. Washington, DC: International Monetary Fund.

- IMF (International Monetary Fund). 2020. Financial Access Survey. Washington, DC: International Monetary Fund.

- International Telecommunications Union. 2020. Global Cybersecurity Index 2020, Measuring Commitment to Cybersecurity. International Telecommunication Union.

- Khadan, Jeetendra. 2018. Suriname. In: D. W. Beuermann and M. J. Schwartz (eds.), Nurturing Institutions for a Resilient Caribbean. 2018. Washington, DC: Inter-American Development Bank.

- Khadan, Jeetendra. 2020a. COVID-19: Socioeconomic Implications on Suriname. Technical Note: IDB-TN-1920. Inter-American Development Bank, Washington DC.

- Khadan, Jeetendra. 2020b. Suriname in Times of COVID-19: Navigating the Labyrinth—Inter-American Development Bank. Technical Note IDB-TN-2025. Washington, DC: Inter-American Development Bank.

- Li, Linyang. 2018. Financial Inclusion and Poverty: The Role of Relative Income. China Economic Review, Elsevier, vol. 52(C): 165-191.

- Machasio, Immaculate Nafula. 2020. COVID-19 and Digital Financial Inclusion in Africa: How to Leverage Digital Technologies During the Pandemic. Africa Knowledge in Time Policy Brief. World Bank: Washington, DC.

- Magnuson, William. 2019. Regulating FinTech. Vanderbilt Law Review 1167. Available at: https://scholarship.law.vanderbilt.edu/vlr/vol71/iss4/2.

- Makina, Daniel and Yabibal M. Walle. 2019. Financial Inclusion and Economic Growth: Evidence from a Panel of Selected African Countries. Extending Financial Inclusion in Africa. Academic Press.

- Mention, Anne-Laure. 2019. The Future of FinTech, Research-Technology Management, 62:4, 59-63, DOI: 10.1080/08956308.2019.1613123.

- National Assembly of Suriname, Legislation Website. n.d. Accessed Jan. 7, 2021. Available at: https://www.dna.sr/wetgeving/surinaamse-wetten/wetten-na-2005/id-kaartenwet-2018/.

- Nicoletti, Bernardo. 2017. The Future of FinTech: Integrating Finance and Technology in Financial Services. Palgrave Studies in Financial Services Technology.

- Omar, M. A. and Kazuo Inaba. 2020. Does Financial Inclusion Reduce Poverty and Income Inequality in Developing Countries? A Panel Data Analysis. Journal of Economic Structures 9, 37 (2020).

- Ong-A-Kwie-Jurgens, Nancy and Daniel Boamah. 2014. Financial Development in Suriname and Its Relationship with Economic Growth. Central Bank of Suriname.

- Ozili, Peterson. 2018. Impact of Digital Finance on Financial Inclusion and Stability. Borsa Istanbul Review. 18(4): 329–340.

- Sahay, Ratna, Martin Čihák, Papa M N’Diaye, Adolfo Barajas, Srobona Mitra, Annette J. Kyobe, Yen M. Mooi, and Reza Yousefi. 2015. Financial Inclusion: Can It Meet Multiple Macroeconomic Goals? Washington, DC: International Monetary Fund.

- Sahay, Ratna, Ulric Eriksson von Allmen, Amina Lahreche, Purva Khera, Sumiko Ogawa, Majid Bazarbash, Kimberly Beaton. 2020. The Promise of FinTech; Financial Inclusion in the Post COVID-19 Era. IMF Departmental Papers / Policy Papers. Washington, DC: International Monetary Fund.

- Sarma, Mandira and Jesim Pais. 2008. Financial Inclusion and Development: A Cross Country Analysis. Annual Conference of the Human Development and Capability Association, New Delhi.

- World Bank. 2015. How to Measure Financial Inclusion. Washington, DC: World Bank.

- World Bank. 2018. Financial Inclusion: Financial Inclusion is a Key Enabler to Reducing Poverty and Boosting Prosperity. Washington, DC: World Bank.

- World Bank. 2019. FinStats Database 2019. FinStats Database. Washington, DC: World Bank.

Bron:

Link:

Interne Link:

Tags: