IMF Executive Board Concludes Article IV Consultation with Suriname – Dec 12, 2019

Related Cases:

-

8 Oct 2024

Press Release No. 19/456

International Monetary Fund

FOR IMMEDIATE RELEASE

Washington, D.C. 20431 USA

December 12, 2019

IMF Executive Board Concludes Article IV Consultation with Suriname

On December 11, 2019, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Suriname.

Suriname’s economy is growing steadily with low inflation. Real GDP grew by 2.6 percent in 2018, following 1.8 percent in 2017. Activity growth has been broad-based with expansions in wholesale and retail trade, construction, hotels, restaurants, and manufacturing, while mining has remained stable. Inflation has fallen below 5 percent, mainly arising from exchange rate stability and control over excess liquidity. The unemployment rate was 7.6 percent in 2017 and is expected to have declined further in 2018. Real GDP is expected to expand annually by 2% to 2.5 percent during 2019-24, while inflation is expected to remain low. However, the balance of risks to this outlook is negative, mainly due to fiscal imbalances. The overall fiscal deficit is expected to reach 8.6 percent of GDP in 2019 while public debt remains high at around 72 percent of GDP.

This year’s Article IV consultation focused on policies to bolster the economy in the medium term. These include fiscal measures to enhance revenues and efficiency and lower expenditures, policies to improve the monetary and financial sector supervision frameworks, and structural policies to boost potential growth.

Executive Board Assessment

Executive Directors took positive note that the Surinamese economy is growing steadily, with a falling unemployment rate, low inflation, and a stable exchange rate. They stressed that this stabilization presents an opportunity to address the central challenges facing the economy, including a weak fiscal position and rising public debt, monetary and financial sector vulnerabilities.

Footnotes:

- Under Article IV of the IMF’s Articles of Agreement, the IMF holds bilateral discussions with members, usually every year. A staff team visits the country, collects economic and financial information, and discusses with officials the country’s economic developments and policies. On return to headquarters, the staff prepares a report, which forms the basis for discussion by the Executive Board.

- At the conclusion of the discussion, the Managing Director, as Chairman of the Board, summarizes the views of Executive Directors, and this summary is transmitted to the country’s authorities. An explanation of any qualifiers used in summings up can be found here.

Suriname: Selected Economic Indicators

| Year | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|---|---|

| Real GDP (percent change) | 5.6 | 1.8 | 2.6 | 2.3 | 2.5 | 2.4 | 2.0 | 2.4 | – |

| Nominal GDP | 19.1 | 23.3 | 74.0 | 118.0 | 126.0 | 80.0 | 107.0 | 60.0 | – |

| GDP deflator | 2.62 | 2.12 | 4.6 | 9.3 | 9.9 | 5.5 | 8.5 | 3.6 | – |

| Consumer prices (average) | 5.5 | 22.0 | 6.9 | 4.5 | 5.8 | 4.7 | 10.2 | 5.1 | – |

| Unemployment rate | 9.7 | 7.6 | 7.1 | 6.7 | 6.3 | 5.9 | 5.5 | 4.7 | 4.7 |

| Labor force participation rate | 59.6 | 59.9 | 60.2 | 60.6 | 60.9 | 61.2 | 61.5 | 61.8 | 62.2 |

| Broad money (percent change) | 5.9 | 8.6 | 8.1 | 9.5 | 9.4 | 7.6 | 7.5 | 7.0 | – |

| Broad money (% of GDP) | 27.7 | 25.3 | 28.0 | 28.8 | 29.3 | 29.7 | 29.4 | 30.2 | 30.7 |

| Reserve money (percent change) | 8.1 | 22.2 | 35.4 | 14.8 | 12.6 | 8.6 | 8.5 | 8.5 | 7.6 |

| Central government debt (% of GDP) | 76.1 | 74.6 | 74.3 | 72.3 | 74.6 | 79.5 | 79.5 | 83.8 | 87.4 |

Sources: Surinamese authorities and Fund staff calculations and projections.

SURINAME

RECENT DEVELOPMENTS

- The economy is growing steadily, and the unemployment rate is falling. Real GDP growth was 2.6 percent in 2018, following 1.8 percent growth in 2017. The Monthly Economic Activity Indicator (MEAI) has, however, slowed during 2019 to 2.5 percent (y/y; 12-m moving average) in July. Activity growth has been broad-based with expansions in wholesale and retail, construction, hotels, restaurants, and manufacturing. Gold and oil production were broadly flat, but gasoline production increased in 2018 due to earlier refinery improvements.The unemployment rate fell to 7.6 percent in 2017 and is estimated to have declined further in 2018. Note: Unemployment rate is calculated based on the survey in Paramaribo and Wanica.Real GDP Growth and Unemployment Rate

![Insert Graph Here]Sources: Central Bank of Suriname; and IMF Staff estimates. - The official U.S. dollar exchange rate remained virtually unchanged last year. Suriname’s de jure exchange rate regime is floating, but the official central bank exchange rate path indicates a de facto stabilized arrangement. The CBvS continues to provide FX directly to the private sector at the official rate for specific import items (notably fuel and pharmaceuticals) and has injected some FX into the banks this year to stabilize the exchange rate. The CBvS does not report any parallel market rates on a regular basis, but occasional information from government officials indicates that exchange houses (cambios) offer a parallel exchange rate, which is more depreciated and more volatile than the official rate. To boost international reserves, a Foreign Commission decree requires small-scale gold miners to sell a portion (currently set at a specified percentage) of the FX proceeds of their gold exports or their gold exports themselves to the CBvS. Boosting reserves should be a policy priority for the central bank; in an economy with a flexible exchange rate, it would not be necessary to do so through targeting the FX or gold of a specific group.Sources: National Planning Office, Staat, and CBvS.

- The central bank (CBvS) has maintained a restrained monetary stance. The CBvS has mopped up excess liquidity partly by unwinding foreign currency swap lines with commercial banks. Ex-ante real interest rates became positive in 2018 as inflation declined. While private sector credit has partially recovered, banks have increased the share of total assets that they hold as reserves with the central bank.Inflation and Interest Rates

![Insert Graph Here]Sources: Central Bank of Suriname; and IMF staff calculations. - Inflation has fallen below 5 percent. The decline in inflation has been broad-based. Exchange rate stability and control over excess liquidity have kept inflation in check. Price controls on certain household items (such as fuel and eggs) have also helped contain inflation.

- The external position weakened in 2018 largely as a result of rising imports, as domestic demand strengthened, and oil exploration led to an increase in capital goods and service imports. The external position is assessed to be weaker than implied by medium-term fundamentals and desirable policies (Annex II). The current account balance worsened from +1.9 percent of GDP in 2017 to -3.4 percent of GDP in 2018, mostly due to higher imports of capital goods and services. This is weaker than the current account norm implied by medium-term fundamentals and desirable policies, which is assessed to be between -0.9 to 1.1 percent of GDP. The real effective exchange rate appreciated by 4.9 percent (y/y) in 2018 due to inflation differentials, and staff assess the real exchange rate is overvalued by 5 to 9 percent. International reserves were at 65 percent of the Fund’s Reserve Adequacy (ARA) metric at the end of 2018 but are expected to rise to around 83 percent of the ARA metric by the end of 2019.Sources: Central Bank of Suriname; and IMF staff calculations.

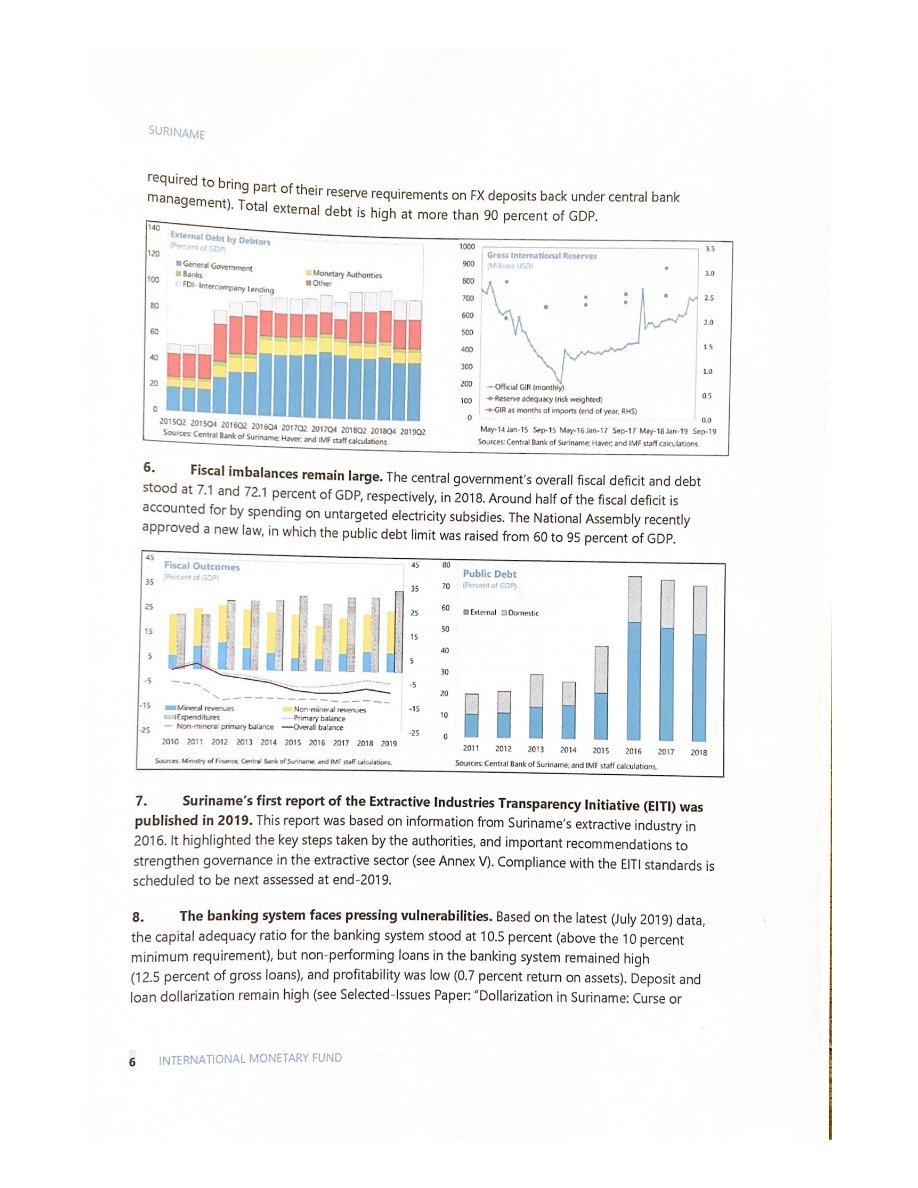

- Fiscal imbalances remain large. The central government’s overall fiscal deficit and debt stood at 7.1 and 72.1 percent of GDP, respectively, in 2018. Around half of the fiscal deficit is accounted for by spending on untargeted electricity subsidies. The National Assembly recently approved a new law in which the public debt limit was raised from 60 to 95 percent of GDP.Fiscal Outcomes and Public Debt

![Insert Graph Here]Sources: Ministry of Finance; Central Bank of Suriname; and IMF staff calculations. - Suriname’s first report of the Extractive Industries Transparency Initiative (EITI) was published in 2019. This report was based on information from Suriname’s extractive industry in 2016. It highlighted the key steps taken by the authorities and important recommendations to strengthen governance in the extractive sector. Compliance with the EITI standards is scheduled to be next assessed at the end of 2019.

- The banking system faces pressing vulnerabilities. Based on the latest (July 2019) data, the capital adequacy ratio for the banking system stood at 10.5 percent (above the 10 percent minimum requirement), but non-performing loans in the banking system remained high (12.5 percent of gross loans), and profitability was low (0.7 percent return on assets). Deposit and loan dollarization remain high.Nonperforming Loans and Capital Adequacy Ratio

![Insert Graph Here]Sources: Central Bank of Suriname; and IMF staff calculations. - The CBvS is making progress in implementing the IFRS standards. Annual financial statements of the CBvS and all CBvS-supervised financial institutions are to be prepared in accordance with IFRS standards starting January 1, 2021. The implementation of the IFRS will help strengthen banks’ credit risk management and improve loan classification, loss provisioning, financial reporting, and audit transparency. Successful implementation will require enhancing supervisory guidelines on credit risk management, loan loss allowances, capital treatment, and regulatory reports. Implementation challenges remain, however, due to capacity constraints and a lack of clarity on how regulations will be affected by the IFRS.

- Monetary financing of the budget has resumed. In early 2019, the government revoked a memorandum of understanding with the central bank that prohibited monetary financing of the budget. Since then, the CBvS has provided new credit (which was also subsequently rolled over) to the government up to the limit of 10 percent of government revenues specified in legislation. The CBvS’s interpretation of the current legal framework is that it does not allow them to continue to provide credit to government in excess of 10 percent of estimated government revenues budgeted for the current fiscal year (and any excess should be repaid within three months). Accordingly, the CBvS is not planning to provide any direct credit to government in excess of 10 percent of government revenues. The new draft Bank Act (prepared by the CBvS, in collaboration with the Ministry of Finance and currently under review by the Ministry of Finance) would eliminate these types of direct monetary financing of the fiscal deficit.

- The CBvS has moved toward international best practice of having banks hold their FX required reserves under central bank management. Banks are now required to place half of their US dollar reserves and all of their euro required reserves under the CBvS’s management. Previously, these reserves were managed by the banks themselves, subject to CBvS guidelines.

Sources: Central Bank of Suriname.

- The CBvS has made good progress in drafting various legislative initiatives to include the Bank Act, Credit Institutions Resolution Act, Banking and Credit Supervision Act, Deposit Insurance Act, Pension Funds and Provident Funds Act, General Pensions Act, Money Transactions Offices Supervision Act, Electronic Payment Transactions Act, and Credit Bureaus Act.

- The authorities launched a money laundering and terrorist financing (ML/TF) National Risk Assessment (NRA) in 2019, with technical support from the Inter-American Development Bank. A project management team that was established earlier in 2019 under the National Anti-Money Laundering Commission is implementing the NRA, which is designed to identify key ML/TF threats and vulnerabilities. The NRA will provide the foundation for the application of a risk-based approach to AML/CFT and help prepare Suriname for the Caribbean Financial Action Task Force (CFATF) Mutual Evaluation, scheduled for 2020. The authorities are amending various AML/CFT regulations to strengthen the legal basis for taking corrective action against non-AML/CFT compliant institutions, introduce clear rules and procedures for reporting suspicious transactions, have domestic politically-exposed persons covered in the AML/CFT rules, and enhance international coordination.

The CBvS is also taking steps to improve compliance of banks and other financial institutions with their AML/CFT-related obligations, including by increasing on-site inspections and off-site monitoring as well as an ML/TF institutional risk rating system.

OUTLOOK AND RISKS

- Staff’s baseline projects an improvement in the real economy through the medium term, but with increased imbalances (baseline scenario in the panel chart). Real GDP is expected to recover, but there are risks related to external vulnerabilities and domestic challenges.